Some brands are getting heavier on inventory than others as shoppers’ concerns about rising interest rates dull demand

By Ryan Felton

The availability of new cars and trucks on dealership lots is bouncing back, and for some brands is stronger than expected.

Buyers are finding a bigger selection of models to choose from this spring selling season, in large part because of easing supply-chain woes and more stable factory output.

The replenished inventory also is shaping up to be an important test for car companies, many of which have said in recent years they would keep availability permanently constrained. Some brands, such as Jeep and Buick, are already getting heavy on stock, according to industry data. If supplies get bloated, it could put an end to the lofty prices and big profits the industry has enjoyed since the pandemic’s early days, analysts say.

“We had times where you could have a helicopter land on my lot,” said David Kelleher, president of a dealership group based in Glen Mills, Pa., that sells the Chrysler, Ram, Jeep and Dodge brands.

Now, he is seeing stock levels swell, including on some specific models, he said.

“We need to enhance sales and stop ordering,” Mr. Kelleher added. “Because of the interest-rate climate, we have to think differently now.”

Overall, dealerships had about 1.8 million vehicles in transit or on lots at the end of April, a 50% improvement compared with the same period in 2022—but still about half the stock available two years before, according to data from industry-research firm Wards Intelligence.

U.S. auto sales have remained resilient, mostly because of pent-up demand, and even picked up in the first quarter of this year as inventory levels improved. Buyers are also still paying historically high prices—the average vehicle sold for about $46,000 in April—and the amount of discounting on the car lot remains well below prepandemic levels, according to data analytics firm J.D. Power.

But fast-rising interest rates are making it harder for many buyers to get into a car they can afford, a dynamic that is starting to weigh on sales, dealers say.

With inventories also coming back, analysts say that pressure will rise to uncork the kinds of promotional deals that have dented profitability in the past.

“We’ve had some stores that have had a super successful spring, and some of the others that really didn’t see the uptick that we normally seasonally would,” said Phil Maguire, owner of the Maguire Family of Dealerships in Ithaca, N.Y.

“The demand is there, but they’re running into a drastic change in their monthly budget where car payments might be doubling,” he added.

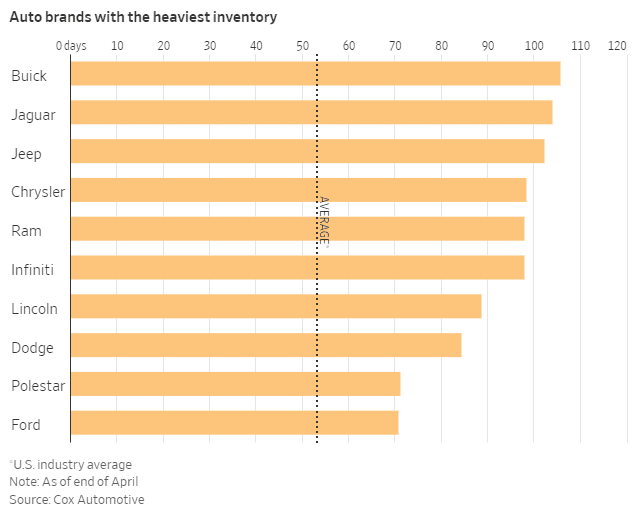

Among the brands leading the inventory build are a number sold by global automaker Stellantis NV. Ram, Jeep and Chrysler each have about 100 days’ worth of unsold inventory or more at the end of April, about double the industry average, according to Cox Automotive. The figure compares with the 60 days that historically has been considered healthy for the industry.

The company’s hefty stock levels, along with declining U.S. sales in the first quarter, prompted one analyst at CFRA Research to downgrade Stellantis’s stock to a hold earlier this month.

“We’re seeing red flags in the inventory data,” wrote Garrett Nelson, the CFRA analyst.

Stellantis executives say the company has been building supplies ahead of the busy spring selling season and it is comfortable with its current inventory position, noting that the brands’ stock levels remain below what they were prepandemic. The company said overall it has 69 days worth of unsold inventory.

Buick, Jaguar and Infiniti were also heavy on stock, each carrying close to 100 days of unsold inventory, Cox’s data show.

Spokespeople for Buick, Jaguar and Infiniti said their method for calculating days’ supply internally shows a lower figure, sales for the brands remain brisk and they are comfortable with their respective inventory levels.

Some other brands, such as Toyota and Honda, remain tight on inventory, carrying stock levels below the industry average, according to the Cox data.

Meanwhile, inventories of pickups have rebounded this year and are nearly back to prepandemic levels, said Mike Wall, an analyst with S&P Global Mobility. Truck buyers are even seeing the return of some sales that had disappeared when supplies were low.

“You know you’re back to normal when the truck month comes back,” he said, referring to automakers’ promotions that largely had gone away in the pandemic era because of short supplies.

Some analysts say the first-quarter prices were likely a peak for the industry, which now will have a harder time getting consumers to pay top dollar.

Those concerns sent stock at both Ford Motor and General Motors down earlier this month, following robust quarterly profits that largely beat Wall Street’s expectations.

“We do expect the [the second half] to see more pricing pressures,” said John Lawler, Ford Motor’s chief financial officer, on an earnings call in May.

In the electric-vehicle market, Tesla already has cut prices by more than 20% this year for some models in the U.S. Ford also has responded by reducing the sticker price on its all-electric Mustang Mach E by as much as 8% on some versions.

Still, after years of empty lots and depressed sales, some dealers are giddy to have something to sell customers walking into showrooms.

“We have cars we can go out and hug now,” said Randy Dye, who owns a Daytona Beach, Fla.-based dealership that sells several Stellantis brands.