Electric-vehicle startups face cash crunch, Journal analysis finds

By Amrith Ramkumar and Shane Shifflett

Electric-vehicle startups were flying high just a few years ago. Now many are focused on survival.

At least 18 EV and battery startups that went public in recent years were at risk of running out of cash by the end of 2024 as of their most recent filings, according to a Wall Street Journal analysis. They include companies such as

That was before they stumbled amid rising costs and manufacturing problems.

Three companies – Lordstown Motors, Proterra and Electric Last Mile Solutions – have filed for bankruptcy. Battery maker Romeo Power and charging firm Volta have been sold at a fraction of their valuations when they went public. Several of those remaining say they are working to reduce costs and have since raised capital.

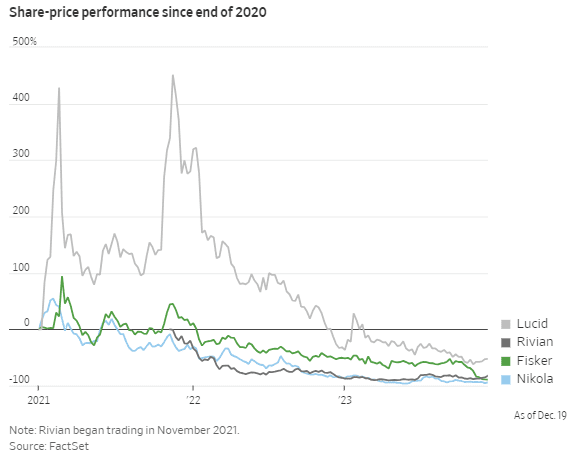

The median stock among the companies that the Journal evaluated is down more than 80% from its market debut, and even further from its peak. The slide has wiped out tens of billions of dollars in market value in just a couple of years.

“It was by far the most insane bubble I have ever seen,” said Gavin Baker, chief investment officer at Atreides Management.

Nearly all of the struggling companies went public through special-purpose acquisition companies. SPACs are alternatives to traditional initial public offerings that surged in popularity during the pandemic. Unlike IPOs, they let startups make unchecked projections about how quickly they could grow.

The rapid change in fortunes for EV startups highlights the risks of investing in the industry, which continues to shift in unexpected ways. Demand is growing steadily, but hasn’t exploded as many startups and investors predicted.

For all its success, even Tesla nearly went bust five years ago, before the company made it through what Chief Executive Elon Musk called “manufacturing hell” and started mass producing its cars.

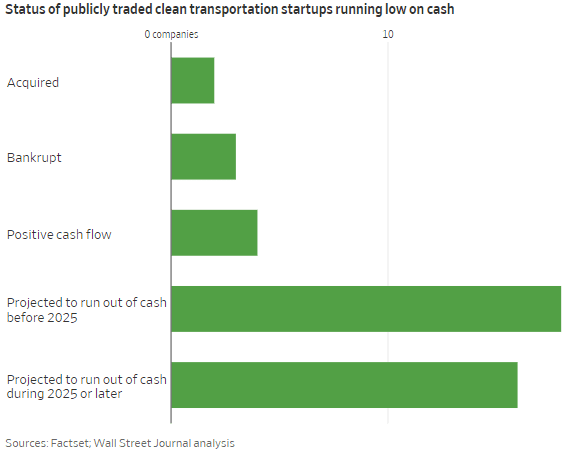

To analyze the performance of EV and battery startups, the Journal identified 43 companies that went public between 2020 and 2022. Five have filed for bankruptcy or been acquired.

To analyze the performance of EV and battery startups, the Journal identified 43 companies that went public between 2020 and 2022. Five have filed for bankruptcy or been acquired.

For the remaining 38, the Journal compared each company’s cash flow from operations with its cash and short-term investments, using the company’s most recent filings compiled by FactSet.

The analysis found 18 companies were on track to run out of cash by the end of next year if they didn’t cut costs or raise new capital. Seven of those had just weeks of cash on hand. When contacted by the Journal, several companies said they raised or are planning new financing, and are cutting costs as they work to boost sales. Nikola, which has raised new capital since its latest filing, declined to comment. A Fisker spokesman said the company’s third-quarter costs aren’t necessarily reflective of future quarters, as it accelerates deliveries and improves logistics infrastructure.

Sixteen had enough cash to keep running beyond 2024, though struggles to increase sales are pressuring many of their share prices. They include Rivian Automotive, which makes pickup trucks that cost roughly $80,000 and promise sports-car handling, and Lucid Group, which makes luxury sedans that come with a similar price tag. Four of the companies were generating cash from operations.

Among those under pressure is Faraday Future Intelligent Electric , which promised record-setting revenue growth when it went public in 2021. The company raised nearly $1 billion to develop a futuristic electric car with features such as self-driving capabilities and facial-recognition technology. The car, which comes with a starting price tag of about $309,000, took longer than expected to produce because of supply-chain disruptions.

Faraday burned through an average of about $875,000 a day in the quarter ended in September. That brought its cash and short-term investments down to about $8.6 million at the end of the third quarter. A spokesman said the company has an agreement to raise capital and is focused on increasing production and reducing costs.

Companies that had a cash runway beyond next year are hitting snags, too.

Li-Cycle Holdings, which hopes to recycle old batteries for materials in electric cars, recently cited rising costs for pausing construction on its first big facility in Rochester, N.Y. That complicated discussions with the federal government about a potential loan.

Among the companies that were in danger of running out of cash by the end of next year is Canoo, which had projected in 2020 that it would generate more than $1 billion in revenue within a few years.

“The targets were all based on a firm market and full access to unlimited capital,” said CEO Tony Aquila, who took over in 2021 after the previous chief executive who made the projection resigned.

Shares of the company are down more than 95% to about 25 cents. Aquila has changed the company’s strategy to save money. He said Canoo has an agreement to raise cash and that he is confident it can raise more from investors, including his family office.

The declines in stock prices have boomeranged on big investors including BlackRock, Fidelity Investments and conglomerate Koch Industries that pumped hundreds of millions dollars into the sector.

BlackRock declined to comment. Fidelity didn’t respond to a request for comment. A spokesman for Koch Industries said the company is taking a long-term view on its investments.

They aren’t the only ones that got burned. Many individual investors also got swept up by the big promises EV startups made when they went public.

“Everyone was out there looking for the next Tesla,” said Brian Dobson, a managing director at investment bank Chardan who analyzes clean-energy companies.