CarMax is thriving despite sky-high used-car prices, rock-bottom consumer sentiment

By Jinjoo Lee

Last year, used-car retailers were on a roll, fueled by new-vehicle shortages, low interest rates and a strong consumer. Are they starting to run out of gas?

Not quite yet. CarMax, KMX -3.13%▼ the largest such retailer in the U.S., reported on Friday that its total revenue grew 21 percent in the quarter ended May 31 compared with a year earlier—higher than the 18 percent increase analysts polled by Visible Alpha were expecting. Net income was largely in line with expectations. Its shares rose 7 percent in midday trading.

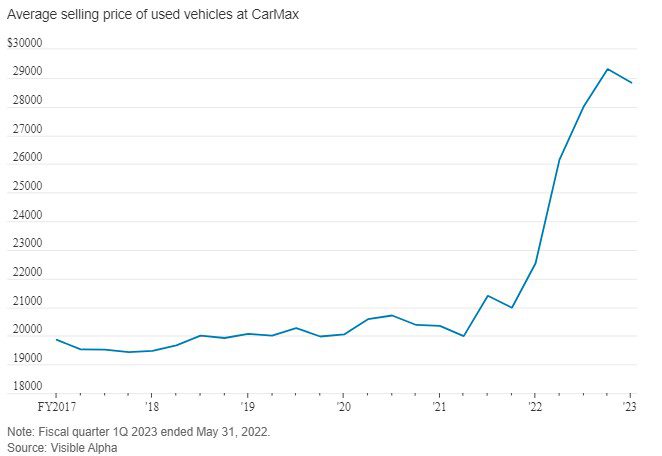

The boost in revenue was mostly thanks to higher prices: While CarMax sold 11 percent fewer used cars, consumers had to shell out $6,311 more per vehicle on average, a 28 percent increase from a year earlier. The company made a gross profit of $2,339 per used car, an increase of $134 compared with a year earlier.

Despite still healthy numbers, it is worth noting that this was the second consecutive quarter of declining units sold year over year, indicating that inflation and rising interest rates are squeezing some consumers out of the market. CarMax noted during its earnings call on Friday that the sales mix has shifted toward older vehicles, with cars four years old or less comprising about half of sales, down from the two-thirds seen a year earlier. Cars in the roughly six-year-old range typically comprise about a fifth to a quarter of sales but made up about 35 percent of revenue in the latest quarter.

Certain trends that kept used-car retail business on full throttle are now slowly reversing. New-vehicle inventory remains tight, which is helping keep prices high on both new and used cars. But used-vehicle supply is starting to return to 2019 levels. As of mid-June, new-vehicle inventory was down 70 percent compared with the same period in 2019, according to Cox Automotive. Used-vehicle inventory has recovered and is down just 11 percent over the same period. Meanwhile, consumer sentiment about buying conditions for vehicles had plunged to the lowest reading in the history of University of Michigan’s survey in June—even worse than perceptions of the housing market.

Another place to watch is CarMax’s lending business, which could start facing pressure as higher interest rates mean funding costs become more expensive. Last quarter’s healthy interest margins largely reflected those from previous years because CarMax has an “earn over time” rather than immediate “gain on sale” accounting model, CarMax noted during Friday’s call. Seth Basham, equity analyst at Wedbush, noted in a research report that the spread between CarMax’s loan rates for consumers and its own funding cost has narrowed to the lowest level since 2008.

CarMax shares remain down about a quarter year to date. There is no cliff in sight, but used-car retail is certainly headed downhill.