Acquisition deals struck by top 150 dealers last year signal accelerating consolidation across the industry

A 20-year friendship helped Liza Borches lock down a four-store acquisition late in 2021, a deal that contributed to her dealership group’s 47 percent jump in new-vehicle sales last year.

Borches, CEO of Carter Myers Automotive Group in Charlottesville, Va., knew the owners of Miller Auto Group from her work as their Honda representative in the early 2000s and had kept in touch. When Miller’s owners decided to sell their franchised dealerships in Virginia and West Virginia, Borches was their first call, she said.

The resulting purchase of the Miller stores helped vault Carter Myers 29 spots up to No. 88 on Automotive News’ latest list of the top 150 dealership groups based in the U.S. Borches said she will consider more acquisition prospects in 2022 and beyond as a way to compete.

“With the consolidation that’s happening across all of the large major automotive groups, we want to make sure that we are keeping up pace,” Borches told Automotive News.

Carter Myers is one of many dealership groups getting bigger and moving up the rankings on the top 150 list. Consolidation already was accelerating when 2021’s banner buy-sell year, widely considered the busiest in history, shook up the rankings of the list’s 10 largest groups — notably Lithia Motors moving past Penske Automotive Group for the No. 2 spot and knocking on the door of No. 1 AutoNation.

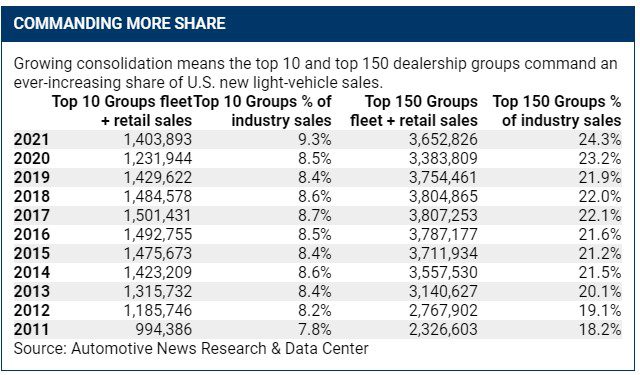

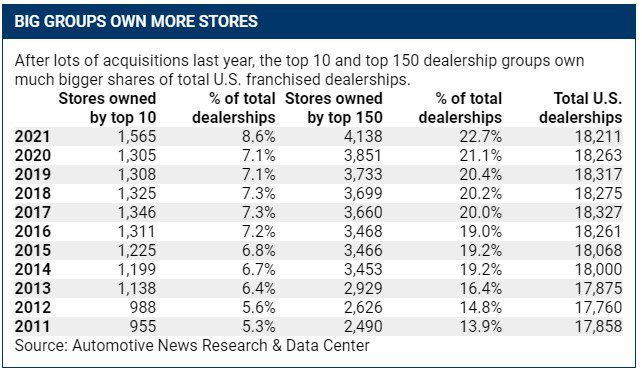

The top 10 and the top 150 groups now own more of the industry’s dealerships and are responsible for a larger share of the industry’s new-vehicle sales.

Dealers who want to be competitive in the long term are realizing it’s time to “get big or get out,” said Alan Haig, president of Haig Partners, a buy-sell firm in Fort Lauderdale, Fla. For the first time in many years, all six of the main public dealership groups are acquiring stores, he said.

“The consolidators have capital,” Haig told Automotive News. “They have confidence, they have support of their shareholders. They’re going to continue to do deals.”

The top 150 groups in the U.S. owned 4,138 stores, including a small but undetermined number of used-only and non-U.S. outlets, at the end of 2021, according to the Automotive News Research & Data Center, which compiles the list. That equates to 22.7 percent of Automotive News’ total count of franchised dealerships in the U.S., up from 21.1 percent for 2020 and 13.9 percent for 2011. The top 10 groups owned 1,565 stores at the end of 2021, an 8.6 percent share of all U.S. dealerships and up from 7.1 percent for 2020 and 5.3 percent for 2011.

The top 150 ranking doesn’t include all of the biggest dealership groups in the country. Some elect not to report their data to Automotive News, and others report intermittently.

Sales share understated

The top 150’s share of industry sales rose by more than a percentage point in 2021. The top 150 groups sold 3,652,826 retail and fleet vehicles last year — 24.3 percent of industry sales and up from 23.2 percent for 2020 and 18.2 percent for 2011. The top 10 sold 1,403,893 retail and fleet vehicles in 2021, a 9.3 percent share and up from 8.5 percent for 2020 and 7.8 percent for 2011.

But those figures actually understate the share of industry sales commanded by the top 10 and top 150.

Dealership groups report only the sales they recorded during the year — but not sales made by an acquisition target before a transaction being finalized. That means the vehicle sales recorded by acquired groups before transaction completion dates go unrepresented on the list.

For example, nearly all vehicle sales made last year by Larry H. Miller Dealerships, the No. 8 group based on its 2020 sales of 61,097 new vehicles, are missing from the tallies on this year’s list. That’s because buyer Asbury Automotive Group finalized its purchase in mid-December and recorded only a couple of weeks’ worth of Larry H. Miller sales for the year. All of the Larry H. Miller vehicle sales will be reported by Asbury for 2022, which means that Asbury has another big bump in sales to look forward to even if it makes no acquisitions this year.

That effect is more pronounced when deals happen late in the calendar year — and there was a flurry of both smaller deals and megadeals in the waning months of 2021. In addition to the Larry H. Miller sale, Sonic Automotive Group Inc. acquired last year’s No. 42 RFJ Auto Partners in December, and Group 1 Automotive bought Prime Automotive Group, last year’s No. 18, in November.

The six main public dealership groups topped the list for most stores gained in 2021. Asbury added the most, tacking on 71 stores, closely followed by Lithia, which added 69, and Sonic, which added 56. Group 1 added 35 stores, Penske added 27, and AutoNation added 21.

Acquisitions in part are being driven by dealers concluding that they need a diverse set of franchises in their markets to meet consumer demands and retain customers, Haig said.

“We really see it in all tiers,” he said. “The publics are growing. The midtiers want to get large, and smaller dealers want to get to midsize.”

More consolidation to come

Several dealers who acquired stores in 2021 told Automotive News more deals are in the cards for 2022.

Morgan Automotive Group broke into the list’s top 10 for the first time, adding eight stores and bringing its total to 53. Seven came from the group’s purchase of Reeves Import Motorcars in Tampa, Fla., in October.

CEO Brett Morgan told Automotive News the group continues to eye acquisition targets, particularly in its key markets in Florida.

More growth is also on the mind of Borches. Expansion allows Carter Myers to offer weightier career opportunities, she said.

“Back in the day when there were a lot of single-point dealerships, you might hit the ceiling of your career as a sales manager or service manager because maybe there were three or four family members at that next level,” Borches said.

LaFontaine Automotive Group, of Highland, Mich., rose 10 spots on the list to No. 33. Its acquisitions in 2021 brought its total to 29 and added brands new to the group — Lincoln and Mazda. But there are still franchises the group doesn’t have — high-end German brands such as BMW, Mercedes-Benz and Audi and luxury British brands Jaguar and Land Rover, spokesman Max Muncey said.

“We have a gap in our portfolio,” Muncey said. “We recognize that, so those definitely are brands we’re looking for.”

LaFontaine’s leaders see opportunity as smaller dealership groups explore selling, something that can be triggered when store owners don’t have a line of succession, he said.

Such exploration means deal-making could speed up more in 2022, experts say.

“We’re gonna see a continued acceleration in consolidation and then the normal sort of changing hands of targets that aren’t really the typical consolidators,” said Mark Johnson, president of buy-sell firm MD Johnson in Enumclaw, Wash.

Click for a link to read the full Automotive News Top Dealerships supplement online.

Jack Walsworth contributed to this report.