By Patrick Manzi, NADA Chief Economist

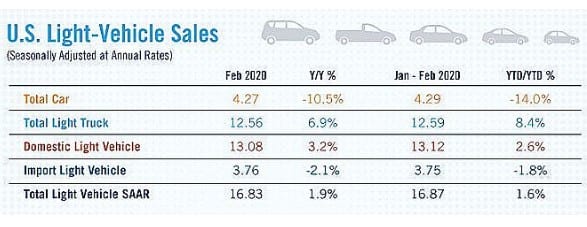

New light-vehicle sales in February were strong, with a SAAR of 16.83 million units for the month—an increase of 1.9% compared to February 2019. Raw sales volume topped 1.3 million units, an increase of 8.4% compared to February of last year.

The sales calendar this February resulted in a distinct sales month. The additional day from a leap year resulted in two more selling days and five selling weekends in February compared to last year. According to J.D. Power, the last time this happened was 1992. Because of such an anomaly, March will have one fewer selling weekend compared to last year and only 25 selling days—the lowest number of selling days since 2015.The spread of the coronavirus (COVID-19) has sent ripple effects through the global economy, though it did not appear to affectU.S. vehicle sales in February. In the past week, stock market upheaval and declines led the Federal Reserve to cut the federal funds rate by 50 basis points to a targeted range of 1.0% to 1.25%. Despite the effort to bolster business and consumer sentiment and combat anticipated economic fallout from the spread of the coronavirus, it is unlikely most vehicle buyers will feel any savings from these rate cuts in the short term. More likely, the most creditworthy individuals could see lower rates on auto finance contracts. Dealers also may feel some relief in floor plan financing costs.

The spread of the coronavirus (COVID-19) has sent ripple effects through the global economy, though it did not appear to affectU.S. vehicle sales in February. In the past week, stock market upheaval and declines led the Federal Reserve to cut the federal funds rate by 50 basis points to a targeted range of 1.0% to 1.25%. Despite the effort to bolster business and consumer sentiment and combat anticipated economic fallout from the spread of the coronavirus, it is unlikely most vehicle buyers will feel any savings from these rate cuts in the short term. More likely, the most creditworthy individuals could see lower rates on auto finance contracts. Dealers also may feel some relief in floor plan financing costs.

Waning consumer confidence may lead to fewer new-vehicle sales in the U.S., though it really is too early to tell. Unfortunately, global vehicle sales will most certainly decline, with China specifically experiencing a significant drop this year. According to Anderson Economic Group, fallout from the coronavirus will cause Chinese vehicle production to decrease by two million units this year. Production stoppages have led to supply chain disruptions for auto production in other parts of the world but have yet to impact North American vehicle production. We expect some impact on North American auto manufacturing, but the timing and extent of the impact isn’t clear and depends on how long Chinese plants remain closed. As of today, we have made no revisions to our 2020 sales forecast of 16.8 million units, but any significant slowdown in new-vehicle sales over the next few months may cause revisions to our sales forecast.