Automaker says it overestimated demand for electric vehicles

Jeep maker Stellantis said it would book charges of about $26 billion, the latest automaker to flush out massive investments in electric vehicles that many Americans are still reluctant to buy.

The company’s Milan-listed shares fell 25 percent to their lowest level since its creation from the 2021 merger of Fiat Chrysler Automobiles and Peugeot maker PSA Group.

Chief Executive Antonio Filosa said the write-downs “largely reflect the cost of overestimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires.”

The charges disclosed Friday are the largest yet reported by an automaker related to bad EV bets, as Detroit reverses course on strategies aimed at reducing emissions and inspired by the stock-market success of Elon Musk’s Tesla. Ford took a $19.5 billion hit in December, while GM last month reported $6 billion in write-downs.

Many consumers have been reluctant to buy EVs because of high sticker prices, worries over range and access to charging stations. Regulatory changes have also changed the calculus, with President Trump rolling back emissions rules and canceling Biden-era tax credits worth up to $7,500 a car.

Stellantis said around two-thirds of the charges related to canceled vehicle platforms and products such as the Ram 1500 EV and Jeep Wrangler 4xe, the bestselling plug-in hybrid in the U.S. Another chunk of the charges relates to the EV supply chain, including the sale of a stake in a Canadian battery plant.

The company, like other automakers, is shifting focus to conventional hybrids, a more affordable technology that doesn’t require drivers to change their habits. It is also reviving popular gas-engine options such as the eight-cylinder “hemi.”

Stellantis had moved hard and fast into new technologies under former CEO Carlos Tavares.

However, in recent years consumer sentiment toward EVs has weakened, prompting the automaker to delay the launch of some planned Ram and Chrysler models.

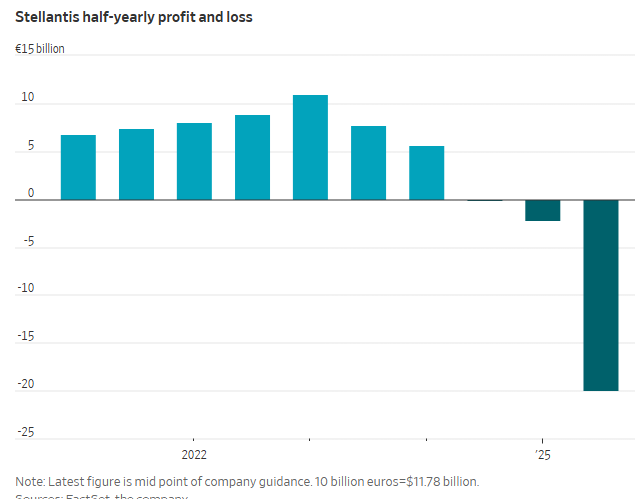

Since becoming Stellantis CEO in June, Filosa has moved quickly to unwind some of Tavares’s bets, including on hydrogen fuel cells. The company announced roughly $4 billion of write-downs in its results for the first half of 2025.

While analysts had forecast further impairments for the second half of the year in the wake of Ford and General Motors’ moves, the 22.2 billion euros bill—equivalent to $26.2 billion—was much higher than expected.

Almost $8 billion of the Stellantis charges are expected to involve cash payments, such as to suppliers that need to be compensated for canceled orders.

The company said it would shore up its balance sheet by suspending dividends and issuing convertible bonds worth up to €5 billion.

Stellantis expects to report a net loss for the second half of 2025 of between €19 billion and €21 billion. Even excluding impairments, the company’s projected profit fell short of guidance reiterated as recently as December. It is scheduled to report full results later this month.

Looking ahead, the company said it expected to return to profitability this year, despite an increase in tariff costs to €1.6 billion.

In May, Filosa is expected to lay out a new strategy at an investor day in Michigan.

Key to growth are product launches as part of a $13 billion U.S. investment plan. The company is bringing back some nameplates canceled by Tavares, such as the Jeep Cherokee, and filling in gaps, such as a midsize Ram pickup truck.

Filosa will also need to find answers to persistent questions about overlaps between the company’s 14 brands and the continuing logic of its trans-Atlantic structure as environmental regulations in the U.S. and Europe diverge.

“Stellantis is a large global company with strong regional roots,” Filosa told reporters Friday.