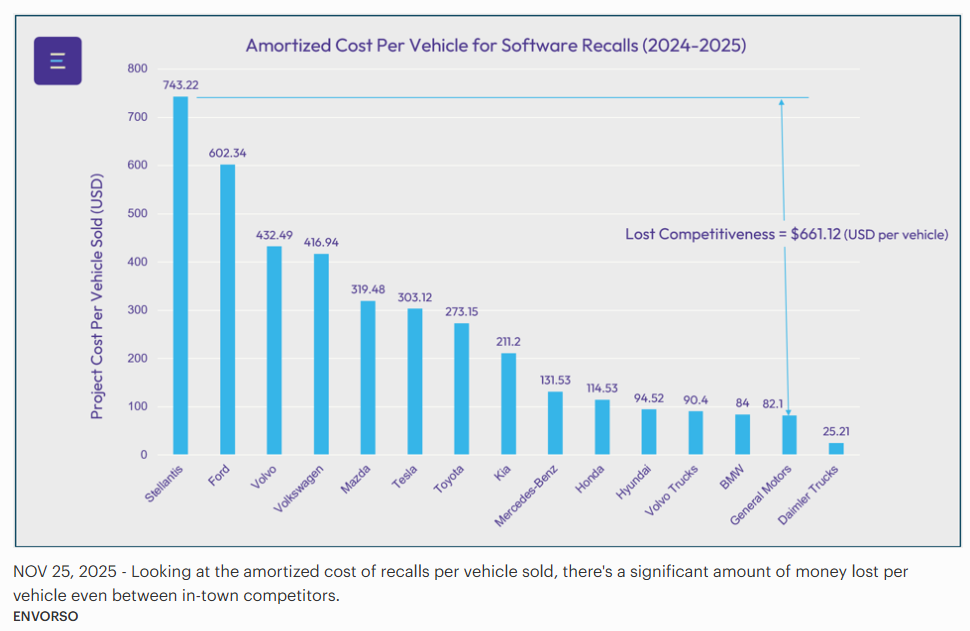

For possibly a record sixth straight year, the number of software recalls will rise past last year’s record for futility. So far in 2025, 166 recalls have affected a variety of automakers. Looking at 2024-2025 together, Tesla has affected the most vehicles (5,777,605), Ford has the greatest number of recall actions (73), and Stellantis suffers from the highest cost per vehicle sold ($743.22) resulting from the software recalls.

“We are watching a pivotal moment in history,” asserts Todd Warren, an adjunct professor of Computer Science at Northwestern University who tracks the NHTSA-reported software recalls on a website along with various statistics including percentage of over-the-air fixes by manufacturer. “Automakers will either fold under the weight of their own technical debt or emerge with a significant, competitive edge given better quality and methods of dealing with issues in the field.”

That competitive chasm might be even more astonishing than the rising numbers of recalls. In a recent article by WIRED entitled “Why Are Car Software Updates Still So Bad,” Carlton Reid suggests the average cost of a recall is $500 and, per Harman Automotive, an over-the-air reflashing of software costs $66.50 per vehicle. Applying those costs to each manufacturer and their varying ability to fix their safety concerns over the air for 2024-2025 saves Telsa billions of dollars. Meanwhile, Ford has the highest overall costs exceeding $2.5B with Stellantis just slightly behind at $1.8B. Comparing those egregious costs to their instate rival, General Motors ($443k over 2024-2025), Ford has a $1B per year disadvantage given just the software recall costs, and each Stellantis vehicle sold has a $661 burden over each GM vehicle. These staggering numbers, however, ignore correlated warranty bills, customer dissatisfaction impacts, and punitive jury damages like the recent $200 million judgement against Tesla.

The Causes

The multivariate equation of contributing causes and associated impacts is incredibly complex and beyond even any analyst or consultant despite the claims by some. It’s worth detailing the underlying themes of root causes to understand possible ways forward.

RISING COMPLEXITY

In the same WIRED article, the author quotes McKinsey that “… since 2021 the complexity of the latest software platforms has increased by about 40 percent per year.” In part, the pressure to add new technology is forcing this with nearly half (48%) of car buyers prioritizing in-vehicle technology over brand or styling and China’s 49.9% year-over-year increase in the installation of Advanced Driver-Assistance Systems (ADAS). To remain stagnant is to fall behind globally.

BIDIRECTIONAL IGNORANCE

Traditional automotive development from the likes of Detroit and Munich have emphasized deep, intentional engineering rigor. Several major consultancies opined about the “talent gap” between Silicon Valley and the auto industry causing several OEMs to attempt the quick fix of injecting “fail fast” methodologies utilized for websites and apps. The strong problem: neither culture understood the necessary elements of each other’s ways of working and how to integrate the required quality aspects with the necessary speed elements. As stated well by Harley Shaiken, a professor emeritus at UC Berkeley, “Silicon Valley isn’t the future, Detroit isn’t the past. They’re both part of the winning strategy going forward.”

TECHNICAL DEBT

According to Planview, over 20% of developmental budgets that were dedicated to new products are “… redirected to address tech debt issues,” which is the accrued cost of legacy code awaiting completion, updates, or corrections. In other words, teams want to go win the next competition but have injuries or unmet obligations from the last game. For corporations that have built vehicles since the dawn of software with an average of approximately 2,000 semiconductor chips per vehicle and possible 30 or more platforms, that historical burden can significantly weigh on strategic plans.

Author’s Note

Amongst my five predictions at the beginning of 2025 was that recalls costs would double, and either Ford or GM would be acquired since they both were lacking the fundamental elements and economic advantages to “… proceed without help” in a costly set of unrealized gambles (e.g., autonomy, Electric Vehicles, Ford’s infamous FNV4 architecture). Although neither prediction has become perfectly true, the trends suggest I wasn’t perfectly wrong either such that minimally Ford needs some aggressive course corrections to avoid this fate.

Sometimes I hate being right.

Find Steve Tengler on LinkedIn and X.