What’s worse for car insurers: a trade war or a price war? Consumers might like the answer, but investors probably won’t.

Back in February, insurance groups began warning that stiff import levies could drive up the cost of car parts and repairs. That, in turn, would hit insurer underwriting profit margins, at least until they got regulatory approval to raise rates. Shares of S&P 500 property-and-casualty insurers are up less than 3 percent so far this year, lagging behind the broader index’s 14 percent rise.

But through the third quarter, this hasn’t yet materialized in insurers’ underwriting profitability, at least not to the degree feared, as tariffs remain in a state of flux. In recent third-quarter reports, loss ratios, or claims costs as a percentage of premiums collected, for personal auto insurance either held steady or improved year-over-year for major auto insurers, including Allstate, Geico, Progressive and Travelers.

However, there is still pressure on underwriting profit coming from another source: competition for policies.

Berkshire Hathaway’s Geico, which primarily writes personal auto insurance, reported a higher ratio of combined loss costs and underwriting expenses relative to premiums earned, from 81 percent in the third quarter last year to about 84 percent in the third quarter this year. The loss ratio related to claims didn’t change much. But the company said a rising underwriting expense ratio so far this year was “attributable to increased policy acquisition-related expenses,” which can include things like advertising spending.

“The competitive environment has gotten stronger, which we knew would happen,” Progressive Chief Executive Tricia Griffith told analysts this past week. The company noted its own “robust media spend and competitive rates.”

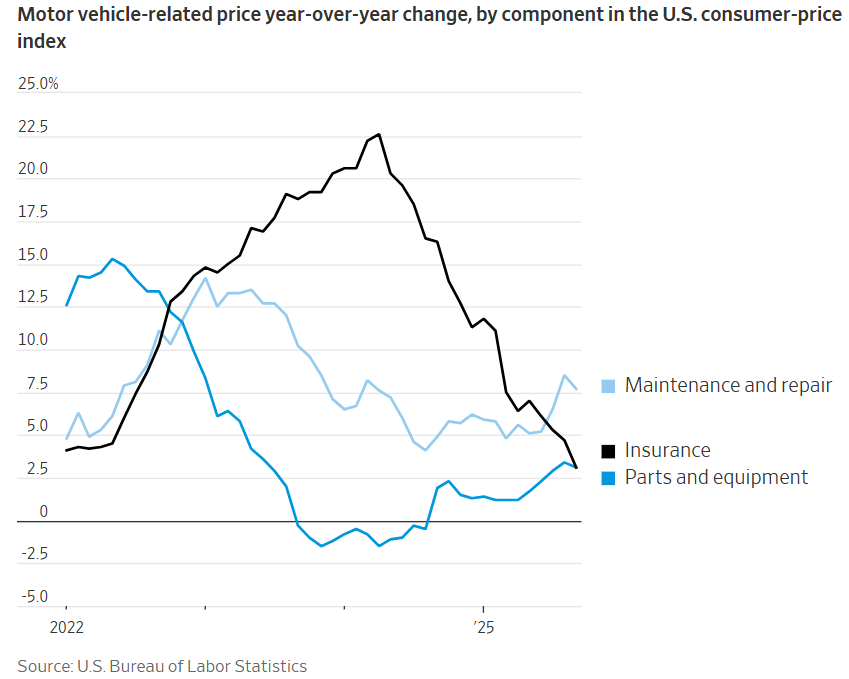

The consumer-price index report for September showed that the year-over-year rise in the cost of vehicle parts, as well as vehicle repair and maintenance, either matched or exceeded that of vehicle insurance for the first time since 2022. A year ago, insurance costs were rising 10 percentage points faster than parts and repairs.

Many car insurers faced big underwriting losses after the pandemic, when premiums didn’t keep up with a surge in inflation of auto-repair costs. Then, they pushed through a series of rate increases through state regulators, and profitability jumped. The second quarter of this year featured the second-biggest net underwriting profit for U.S. property-and-casualty insurers since at least 2001, according to S&P Global Market Intelligence.

Then early this year, there was a jump in the number of insurers seeking negative rate changes in filings with state regulators. The introduction of tariffs, however, slowed those requests, according to an analysis by economists at the Swiss Re Institute.

Still, even to the extent tariffs have triggered some higher loss costs, the expectation is that U.S. auto underwriting overall will continue to be a profitable business in the near term, according to Tim Zawacki, principal research analyst for U.S. insurers at S&P Global Market Intelligence.

“Ultimately, there’s going to come a time when data supports significant rate decreases,” he said.

There are other hangover effects, too. Progressive reported a $950 million underwriting expense for a policyholder credit in Florida, where the company said insurance rules require it to return profit to customers when underwriting margins exceed a certain level. The company told analysts that a few other states also have laws on excess profits, but it didn’t “foresee other similar exposures.”

More people are also shopping around for car insurance. Allstate said that its tracking of shoppers in auto insurance was up over 9 percent from last year so far in 2025.

Tracking by economists at the Swiss Re Institute indicates a trailing 12-month rate increase in personal auto of 2 percent in September, down from 10 percent a year prior. The economists are forecasting a broader decline in U.S. property-and-casualty insurers’ overall profitability, from a 12 percent return on equity in 2025, to 10 percent next year.

Big players aim to sew up longer-term relationships with bundled policies, to be less vulnerable to pure price-shopping. And there might be offsetting trends in other products, such as homeowners’ insurance.

But whether it is an unexpected jump in claims costs or lower premiums that are the instigator, the upshot is that auto-insurance underwriting might now be past its peak profitability.

Write to Telis Demos at Telis.Demos@wsj.com