A new study challenges the notion that auto shows are relics of the past, indicating that in-person vehicle events drive purchase decisions and brand engagement in an increasingly digital market.

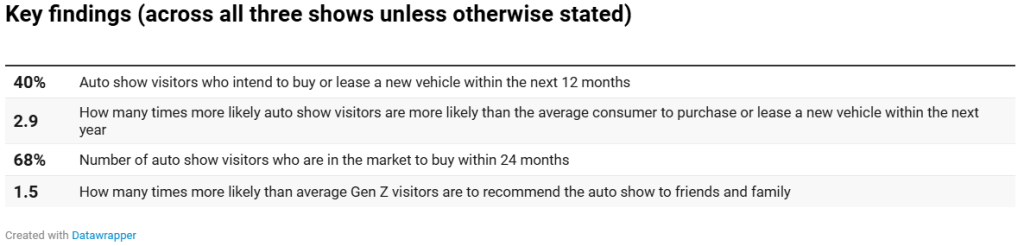

According to the report by Clarify Group, visitors to North America’s three largest events in Toronto, New York and Los Angeles are nearly three times more likely to purchase a new vehicle within 12 months compared with the average consumer. Clarify’s findings are based on responses from almost 9,000 attendees of the 2024 Los Angeles Auto Show, and the 2025 Canadian International Auto Show, shown, and New York International Auto Show.

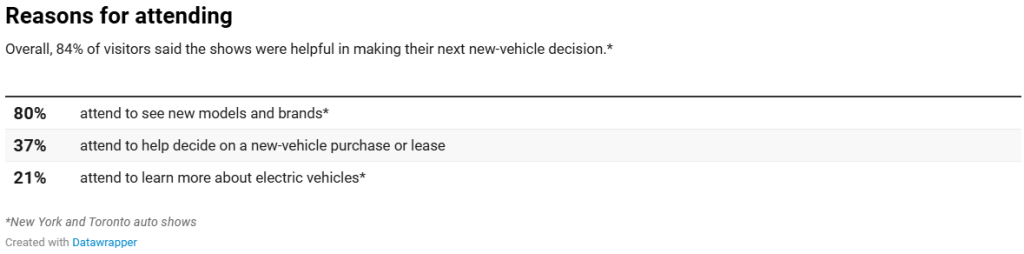

“The new-vehicle buying journey today is really a blend of online and in-person experiences,” said Darren Slind, co-founder and president of Clarify Group, a Toronto-based automotive consultancy. “Only a small minority of shoppers are fully digital or fully in-person,” Slind said in an interview Oct. 21. “Most consumers use both, and auto shows bring that experience together in one place and at one time.”

The report was commissioned by the three auto shows, and its findings are based on responses from almost 9,000 attendees of the 2024 Los Angeles Auto Show, the 2025 Canadian International AutoShow and New York International Auto Show.

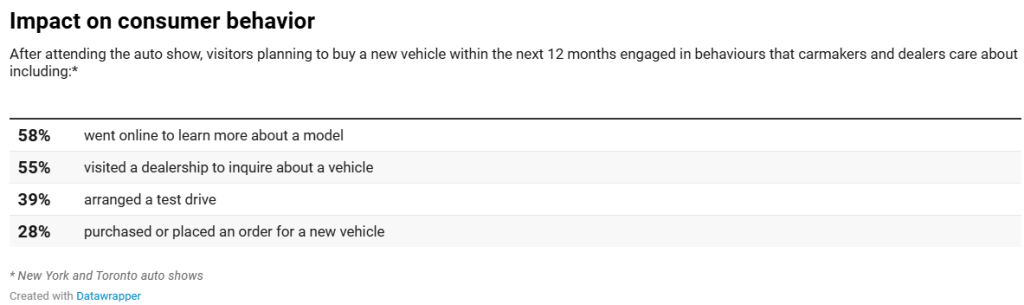

Clarify’s research found that the average attendee spends more than four hours at a show and experiences about nine vehicles up close — something automakers would struggle to replicate elsewhere.

Slind said the shows deliver strong value for exhibitors.

“Auto shows don’t replace digital marketing, they accelerate it,” he said. “They amplify those online efforts and drive the behaviors that both OEMs and dealers care about.”

Gen Z leads the enthusiasm

A key finding is that Generation Z visitors — ages 20 to 29 — are the most enthusiastic promoters of auto shows. Slind said the pattern has been consistent for three consecutive years and across multiple markets.

“These younger buyers appreciate the educational value of the show,” he said. “With prices at record highs and technology changing rapidly, they don’t want to make a bad decision. Auto shows help them learn, compare and even test-drive vehicles — efficiently and in person.”

The shows’ growing emphasis on hands-on experiences, including indoor and outdoor EV test tracks, has been particularly popular with this audience, he said.

‘Out of sight, out of mind’

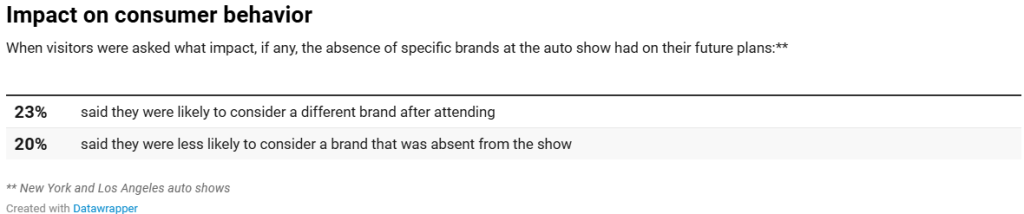

The study also found that a brand’s absence from an auto show can harm its standing with consumers.

“Out of sight, out of mind — that’s the challenge,” Slind said. Exhibiting brands saw 2.5 times the increase in purchase consideration, while nonexhibiting brands suffered a threefold decline. About 20 per cent of visitors said they were less likely to buy from a brand that skipped the event.

“The stakes are high,” Slind said. “In a mature market like North America, it’s about protecting and growing share. OEMs don’t want to gift that consideration to their competitors.”

Toronto’s comeback

Clarify’s findings come as auto show season gets under way with the Los Angeles event set for Nov. 21-30.

CIAS, one of the healthiest events on the North American circuit, will be Feb. 13-22 at the Metro Toronto Convention Centre. The 2025 event drew 323,521 people and saw the return of Audi, BMW and Mercedes-Benz.

But Honda, Volkswagen and Mazda were among the no-shows and have no plans to participate next year.

“After thoughtful evaluation, Mazda Canada has decided not to participate in Canadian auto shows in 2026,” said company spokesperson Sandra Lemaitre. “Instead, we are prioritizing more personalized, one-on-one engagement and deepening our investment in local communities. This approach enables us to showcase our vehicles and connect with consumers in more meaningful and impactful ways throughout the year.”

John Bordignon, a Honda Canada spokesperson, said the automaker “continues to look for ways to effectively market our brands in our new business climate that will satisfy revised business strategies and goals.”

Part of that process included an annual review of auto show involvement, marketing, sponsorship and advertising activities, he said. “As a result, Honda and Acura Canada have decided not to participate in the 2026 Canadian auto show season.”

At Volkswagen, spokesperson Thomas Tetzlaff said “in certain circumstances” local dealers can decide whether to exhibit vehicles at their shows.

CIAS General Manager Jason Campbell said 26 brands have committed to the show, although the list of exhibitors won’t be finalized until the last week of November.

“It’s not just about seeing the vehicles — it’s the experiential and entertainment aspects, from EV test tracks to family-friendly exhibits,” said Slind. “But make no mistake, two out of three visitors are there because they’re in the market for a new vehicle.”

Ultimately, said Slind, “auto shows sell cars. They bring digital marketing to life.”