Demand for pickup trucks and hybrid vehicles helps automakers increase deliveries; challenges loom for 2025

The auto industry eked out a small increase in U.S. vehicle sales for 2024, helped by better availability on the new-car lot and a flurry of promotional deals in recent months.

U.S. dealers sold 15.9 million vehicles last year, up 2.2 percent from 2023, according to an estimate Friday from research firm Wards Intelligence. A robust holiday selling season lifted the final tally, with December car sales growing 6 percent.

Several automakers on Friday reported strong U.S. sales for the final months of 2024, including Ford Motor and General Motors. Both posted fourth-quarter rebounds from strike-marred results in 2023.

GM’s sales for the October to December period rose 21 percent, helped by strong demand for the Chevrolet Suburban and other large SUVs. Ford’s F Series pickups drove the automaker to a 9 percent gain for the quarter.

Toyota Motor, the world’s largest automaker by vehicle sales, said U.S. sales slid 7 percent in December but rose 4 percent for the year. Hyundai Motor posted a 10 percent increase for the fourth quarter. Both companies were helped by solid results for their electric and hybrid models.

The inventory shortage that had plagued the U.S. car market for years eased in 2024. With greater selection, American shoppers gravitated toward more-affordable models as well as leases, which rose sharply to account for nearly a quarter of all U.S. sales.

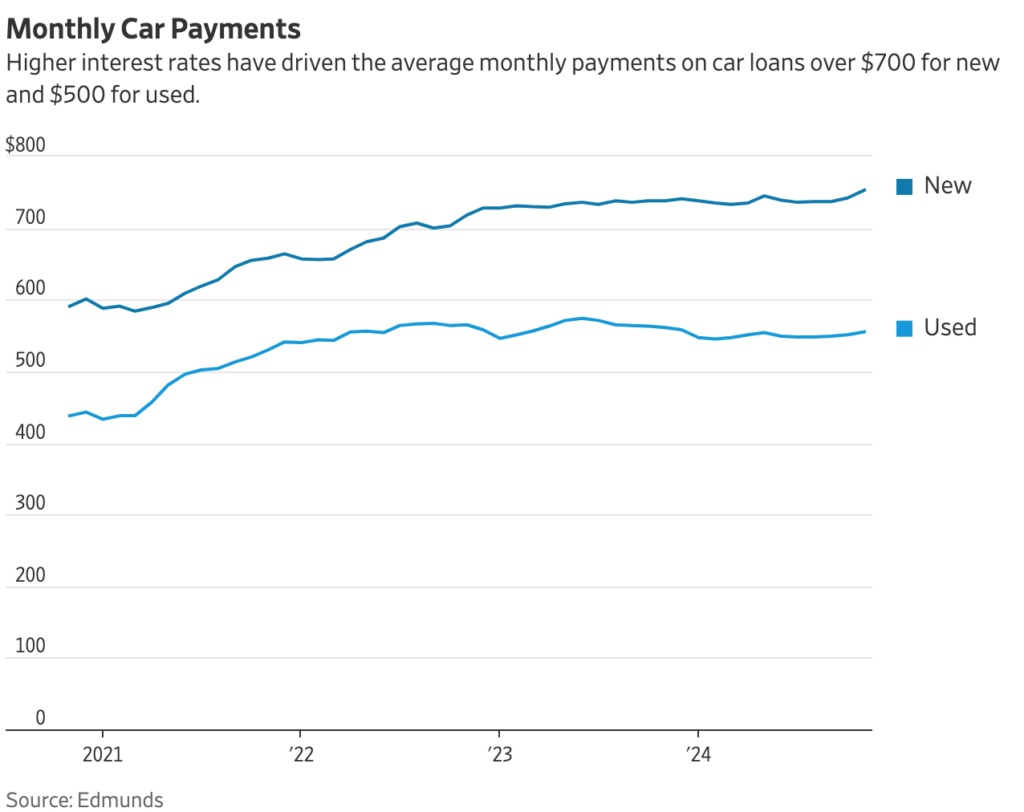

For 2025, analysts see another small rise in car sales, but also some potential trouble spots. New cars are still expensive, especially with interest on car loans pushing average monthly payments above $750.

The electric-vehicle transition has been slower to materialize than many car executives expected. And President-elect Donald Trump’s proposal to place steep import tariffs on goods from Canada and Mexico could disrupt the industry and make the cheapest new cars significantly more expensive.

Here is a look at crucial aspects of the U.S. auto market heading into 2025:

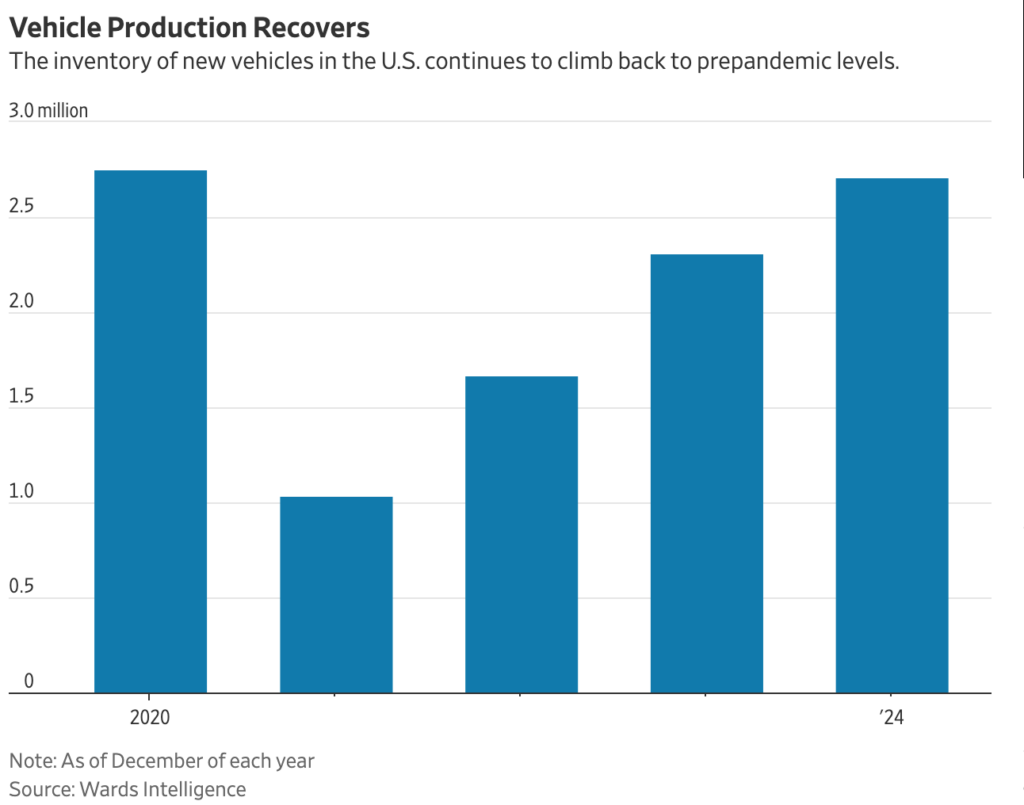

More cars on the lot

Vehicle availability has continued to bounce back from pandemic-era lows, when supply-chain disruptions shrank the number of cars at U.S. dealerships to about one million in late 2021. Last month, that number had rebounded to about 2.7 million vehicles, according to research firm Wards Intelligence.

As production has recovered, automakers have been offering more promotions, such as cash-back deals and low-interest financing, to keep sales moving. Car buyers received on average about $3,400 in incentives last month, an increase of 25 percent from a year ago, according to J.D. Power data.

Car payments are still high

Even as new car prices have eased, car payments haven’t, primarily because of high interest rates. The average monthly payment on a new-car loan was $753 as of November, up from $738 a year earlier, according to car-shopping site Edmunds.

The Federal Reserve’s moves to trim short-term interest rates in late 2024 haven’t translated into much relief for vehicle shoppers, with interest rates on new-car loans hovering around 7 percent and rates for used cars around 11 percent according to Edmunds data.

Bright prospects for hybrids

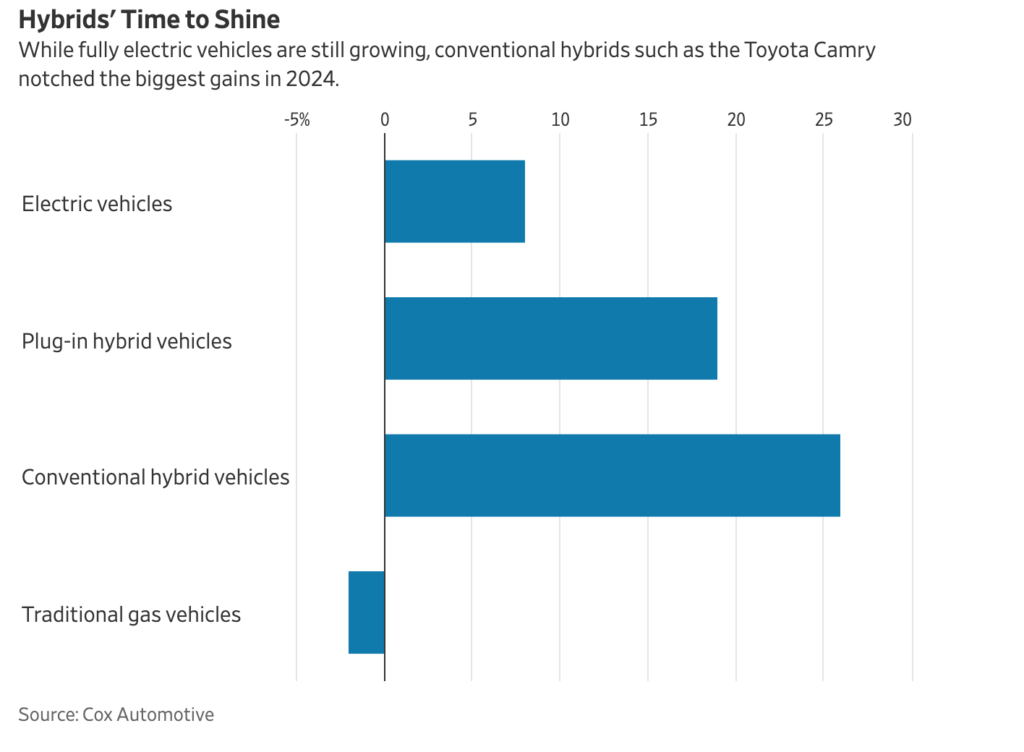

Electric vehicles continue to increase as a share of the U.S. auto market, but conventional hybrids notched the biggest gains in 2024, according to Cox Automotive.

Hybrid versions of popular gas-powered models, such as the Toyota Camry and Honda Civic, use small batteries to improve the fuel economy on their gas engines. These cars don’t plug in or run on electricity alone, meaning consumers don’t have to change their driving habits.

Toyota Motor, the leader in hybrid vehicles, said U.S. sales of hybrids and EVs rose more than 50% last year, accounting for 43% of its total sales.

David Christ, general manager of Toyota in North America, said hybrid versions of popular models, such as the RAV4 SUV, sell at a faster pace than their gas-powered counterparts, despite prices that are about $2,000 higher on average.

“It’s worth it to them to pay that additional price to get the hybrid,” Christ said in an interview Friday.

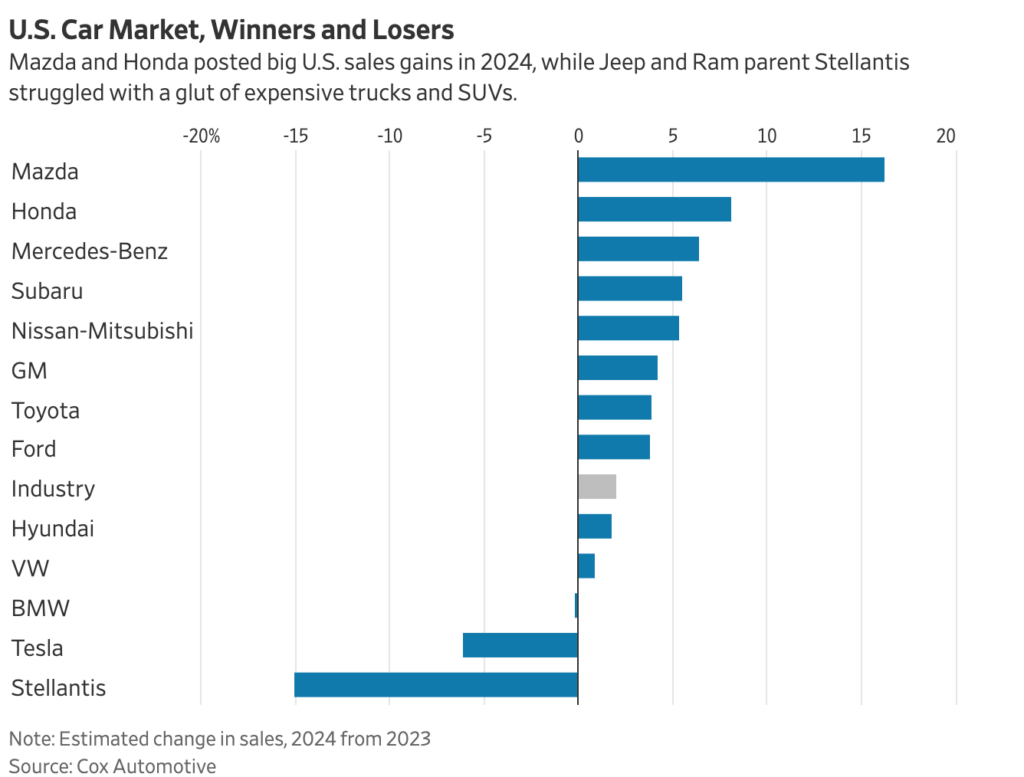

Winners and losers: Mazda and Honda gain; Jeep, Ram and Tesla retreat

Japanese automakers Mazda and Honda grabbed U.S. market share in 2024, based on preliminary figures from Cox.

Mazda’s sales climbed 16 percent, benefiting from a yearslong strategy to remodel its dealerships and move upmarket with pricier SUVs.

Rivian’s shares surged 24 percent on Friday after the electric-truck maker said it delivered 14,183 vehicles in the fourth quarter, above the 13,000 estimate of analysts polled by FactSet. For the year, the company’s 51,579 vehicles sold was in line with Wall Street’s forecasts.

Stellantis, the parent of Jeep and Ram, was the U.S. market’s underperformer in 2024, with sales sinking 15 percent. U.S. dealers have complained throughout the year that high prices on Jeep SUVs and Ram pickups chilled sales. Troubles in the U.S. market contributed to the departure last month of Stellantis Chief Executive Carlos Tavares.

Tesla, the leader in the U.S. electric-vehicle market, reported a global sales decline in 2024 after more than a decade of growth. The Texas-based company headed by Elon Musk doesn’t disclose country-specific sales, but Cox estimates its U.S. sales suffered a decline of about 6 percent in 2024.

U.S. Car Market, Winners and LosersMazda and Honda posted big U.S. sales gains in 2024, while Jeep and Ram parent Stellantisstruggled with a glut of expensive trucks and SUVs.

Car buyers are moving back toward leasing, with the share of sales completed through leases rising from 20 percent in 2023 to 24 percent last year, according to credit-reporting firm Experian.

Leasing offers consumers a new car at a lower monthly payment, making the option attractive given the effect of high interest rates on purchase loans.

Leases are on the rise partly because some electric vehicles qualify for federal incentives only through leases, helping drive the share of EV sales through leasing to 72 percent as of November, according to Edmunds.

Write to Christopher Otts at christopher.otts@wsj.com