Average price paid is expected to fall this year for first time since 2008, but interest rates keep payments high

Many Americans are hitting their breaking point on what they are willing to spend on a new car, as higher interest rates take a bite out of what they can afford.

The average out-the-door price for a new vehicle is on track to drop in 2024 for the first time in more than a decade with dealerships restocking lots and monthly payments rising because of increased financing rates.

Already through June, the average price paid for a new vehicle fell 3 percent over the same prior-year period to about $45,000, according to research firm J.D. Power. And analysts expect prices to ease further throughout the year as car-market dynamics normalize after a topsy-turvy few years of supply constraints.

Most automakers reported their latest sales tallies this week with industrywide deliveries up an estimated 2 percent for the first half of the year, data provided by Wards Intelligence show.

Despite the drop, many car buyers still are stretched thin. The average selling prices remain much higher than they were before the pandemic, and automakers and dealers haven’t returned to the freewheeling promotions that car shoppers had come to expect in the past.

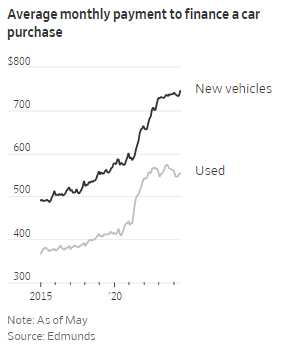

Meanwhile, higher interest rates are saddling consumers with bigger monthly payments despite moderately better deals. Monthly car payments reached a record high of $740 in the second quarter, according to Edmunds.

“We’ve seen customers who bought a premium car over the last few years coming back to reality,” said John Patterson, a car dealer with Hyundai, Kia and Mazda stores in Southern California.

Car buyers earlier this decade were more easily able to swallow higher prices partly because rates were lower, and they were more inclined to splurge amid the car shortage, Patterson said. The affordability challenges have kept some consumers away from dealer lots so far this year, dealers and auto executives say.

Higher car prices have been a core factor fueling broader inflationary pressure on Americans over the past few years. Core consumer prices—excluding food and energy—in May posted their mildest gains since 2021, a Labor Department report said last month.

Most major automakers reported their latest vehicle sales numbers on Tuesday. Ford Motor Co. on July 3 said second-quarter sales ticked higher by about 1 percent, in line with General Motors results. Tesla’s global vehicle deliveries slid for a second straight quarter but not as much as expected. The company doesn’t break out U.S. deliveries.

Jeep maker Stellantis’ sales sank 21 percent in the quarter, hurt by weaker sales at its Ram pickup brand. The automaker on Tuesday announced a promotion that will offer buyers up to $2,000 in cash back across many models.

A cyberattack last month that left thousands of dealers without crucial software for running their businesses dented results. Software provider CDK Global said Tuesday that nearly all dealers were back online, but the outage was estimated to have cost dealers sales of around 50,000 vehicles, according to Wards Intelligence.

For years following the 2008-09 financial crisis, average selling prices ticked higher, driven in part by consumers rotating out of smaller sedans and into larger, pricier SUVs and pickup trucks.

That upward trend shot higher in the pandemic era, when shortages of computer chips and other parts curbed factory output. Buyers—confronted with near-empty lots and monthslong waits for cars—were willing to pay top dollar.

Supply chains began normalizing last year, and dealer inventory has rebounded, although it remains below prepandemic levels. Industrywide, there were about 2.7 million vehicles on dealership lots or en route to stores at the end of May, up 50 percent from a year earlier, according to research firm Wards Intelligence.

That increased supply has taken the edge off the industry’s firm pricing power, leading to an uptick in some discounts and promotions. Nonetheless, higher rates for new-car purchases have hovered above 7 percent for several quarters, leaving car buyers “stretched to their financial limits,” car-research site Edmunds said this week.

Even though the average price paid has fallen, prices likely need to fall further to bring more buyers into the market and propel industry sales higher, said Jessica Caldwell, Edmunds’ head of insights.

For automakers, that pricing power has padded the bottom line, with many posting record profits over the past two years.

Executives and analysts had expected the industry’s pricing power to wane as the vehicle shortage faded and car inventories rebounded. But, while pricing has edged off from the peak, the deals aren’t flowing nearly as freely as they did historically.

Before the pandemic, financial incentives from the manufacturer and dealer typically whacked 10 percent off the sticker price on average. In the first half of the year, the average reduction was about 5 percent, J.D. Power data show.

General Motors has commanded prices that are running above what executives expected at the start of the year, GM Chief Financial Officer Paul Jacobson said at an investor conference last month. The company figured the average price paid for its vehicles would fall by at least 2 percent this year.

“We haven’t seen that,” Jacobson said. GM cited resilient pricing as one reason the company raised its 2024 profit outlook in April.

To sustain the pace of car sales, though, auto manufacturers and dealers have been digging deeper on their promotions. More financing packages are being offered with discounted interest rates, dealers say.

Still, the pressure from higher rates and the rise in prices in recent years has shocked some buyers who have returned to showrooms in recent months, said Joe Hay, president of a Ford dealership in Bakersfield, Calif.

“It’s been a very tough pill for a lot of consumers to swallow,” he said.

Write to Ben Glickman at ben.glickman@wsj.com