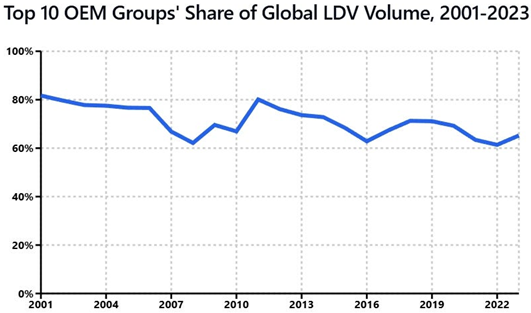

A look at the long-term trend in OEM consolidation

By Glenn Mercer

Winter is the season of marriage proposals: in much of the world it’s the most popular time to pop the question.¹ And it seems now the entire global automotive industry has decided love is in the air, what with Honda and Nissan apparently headed to the altar². The usual rationale has been dusted off and revived: “We need more scale, to pay for [ fill in the blank ] EV / AV / mobility services / software / platforms / a bigger headquarters / banker fees…”

The track record of scale-seeking mergers is shaky at best: one could enumerate dozens of tie-ups that flopped. And evidence on scale economies in automotive is itself weak, such that the late lamented Sergio Marchionne was (possibly apocryphally) once quoted as saying that “The minimum economic scale of a car company is always 2 million units larger than the size of the company of whose CEO you asked the question!”

We’ll leave the pro and con M&A debate aside for now (though contact me if you want a look at my own research into the topic) but instead just present a possibly-relevant chart on: just how consolidated is the global OEM industry? Have we been marching our way to conglomerations which control ever-larger shares of the market?

Um, no.

The share of global light duty vehicle production controlled by the ten largest OEM groups has been gently drifting downwards. I was too lazy to go back and look before 2001, but I do have an old chart showing a figure of 82% for 1990, supporting my point further.

The shifts behind this result include among other factors the two big Americans of GM and Ford retreating back to their profitable home market, and Chinese entrants such as SAIC and BYD rapidly growing.

But the rationale, or lessons learned, from this chart are harder to parse. Are OEMs avoiding M&A because they feel they are already big enough to compete (that is, are returns to scale – beyond a certain point – just not as strong as we might have thought they were)? Or are they collectively being foolish about this and had better step up growth (organic or via merger) right away? Or do we think that even if the scale effects are there, they are just too hard to capture via M&A? (Again, let’s face it, a lot of tie-ups, maybe even most, have failed to deliver.³)

So I don’t know what to read into this curve: it could equally indicate we think M&A is not the answer… or, that a new M&A wave is long overdue. So as they say in the rom-com movies, as Honda and Nissan approach the altar: “Speak now or forever hold your peace.”⁴

(By the way, I acknowledge that the calculations underlying this line are fraught. In drawing this, one has to decide questions such as: do I include the truck divisions of OEMs? do I count sales or do I count production? was Mazda “part of” Ford back when, or should I count it separately? etc. We can argue these points, but the reason I went back so many years with the chart is to allow time for the puts and takes to somewhat average out and cancel each other out.)

1 As always, Car Charts eschews opinions for facts. See “Winter continues to be the most popular season for couples to get engaged, most notably in North America and Western Europe.” From the Global Wedding Report. You don’t get sources like these in other automotive publications, now do you?

2 If you think that is a strange pairing, well go back and reflect on the successive Chrysler weddings (not even counting AMC and Mitsubishi): DaimlerChrysler, CerberusChrysler, FiatChrysler (Fiat itself rebounding from a brief fling with GM), and now Stellantis. See the world’s expert on serial marriages, Zsa Zsa Gabor, who said “A girl must marry for love… and keep on marrying until she finds it.”

3 And M&A has working against it the need for fast action. More than one OEM executive who has been through the merger mill has told me it takes something like two years just for everyone to figure what they are doing, in the new combined entity (and for all the jockeying for the diminished number of C-suite spots to play out). If you have to move as fast as say, BYD, today, can you afford to divert all your managers into merger-integration work?

4 Naw. We’ll second-guess all this endlessly after the fact, regardless! Human nature dictates we’ll never “hold our peace.” So therefore I have a few comments to make about the Cleveland Browns Watson decision back in 2022…