By Ben Glickman | ben.glickman@wsj.com

Discounts abound as automakers and dealers try to entice hesitant shoppers to make the switch

Electric vehicles were a splurge purchase not long ago. Now they are among the biggest bargains on the dealership lot.

Many electric models have never been cheaper, as automakers splurge on financing deals and cash incentives to sway consumers who might be hesitant to give up their gas guzzlers. The steeper discounts will serve as a test of Americans’ appetite for going electric after months of slowing demand.

Four of the five vehicle models with the biggest drop in list price over the first half of this year were electric, including the Chevrolet Blazer and Volkswagen ID.4 SUVs, according to shopping site CarGurus.

On average, buyers paid about $1,500 more for nonluxury EVs than internal combustion engine vehicles, according to a July J.D. Power report. Just over a year ago, the average EV fetched $8,400 more.

In some cases, electric models that once came with a hefty premium are actually cheaper than their combustion-engine equivalents. Ford Motor’s F-150 Lightning—the centerpiece of the company’s EV strategy when it was unveiled in 2022—is selling for about $5,000 less than its gas-engine alternatives, according to J.D. Power data.

Still, it won’t come cheap for the car industry: Discounts and deals make EVs that have already drained billions from legacy automakers’ bottom lines even less profitable. Several major automakers are scheduled to report quarterly earnings this week, including Tesla, General Motors and Ford.

Tesla kicked off the trend last year when it began to slash the starting prices for its basic models. Competitors followed suit, leading to an EV price war that has heated up this year.

Car companies have cut their sticker prices for certain battery-powered models. Dealers and manufacturers are also dangling financing deals and cash rebates to draw in consumers, who in some cases can also pay less with the help of federal tax credits.

Jim Walen, who owns Hyundai, Jeep and Chrysler-Dodge-Ram dealerships in the Seattle area, said pricier EVs aren’t as hot as they had been, as early EV enthusiasts have given way to more price-sensitive consumers. Shoppers now are gravitating to less-expensive electrics.

“They’re driven by where the value is,” he said. “With government incentives, it’s a jigsaw puzzle.”

‘Waiting for the customers’

Carmakers have been rolling out many new electric entries, pressured by tightening fuel-economy regulations and competition from Tesla and other newcomers. But demand has been weaker than expected, triggering the need for steep discounts.

“The overall competitive landscape for electric vehicles is intensifying,” said Stephanie Valdez Streaty, director of industry insights for research firm Cox Automotive.

The steep discounts haven’t been enough to fuel a return of the torrid EV sales growth of a few years ago. Sales of fully electric models rose 6.8 percent through the first half of the year, according to Motor Intelligence data, a sharp deceleration from near 50 percent growth in 2023.

Korean automaker Kia has been among the EV sales leaders in the U.S., with its EV6 midsize SUV released a few years ago, and the recent launch of the larger EV9. The company has seen sales rise as it has ramped up cash rebates, said Eric Watson, vice president of sales at Kia America.

“There’s a lot of manufacturers now introducing new electric vehicles and starting to produce them in volume,” he said. “We’re waiting for the customers to catch up.”

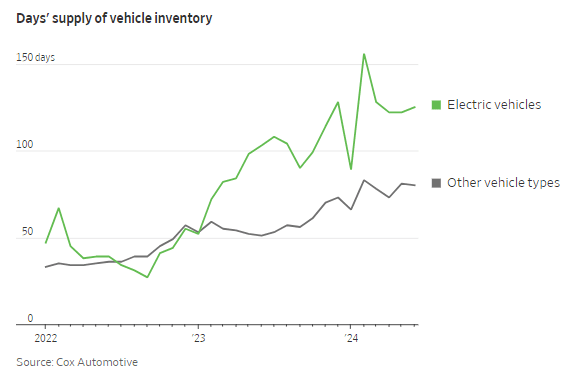

Over the past year, weaker demand for battery-powered cars and trucks has left dealers with too much stock, triggering more discounts and cheap-lease offers. Dealerships on average held 125 days worth of supply for EVs as of the beginning of June, according to Cox Automotive, well above the industry norm of around 60 days.

While lower prices could entice some shoppers, consumers have other concerns with electric offerings, such as range anxiety and lack of publicly available chargers.

Automakers have cited a lack of lower-priced choices as one of the biggest barriers to wider acceptance of EVs, and several manufacturers are racing to introduce sub-$30,000 models.

Jeep-parent Stellantis and Ford Motor have said they are developing less expensive electric models for the U.S. market as broader demand slows, while Tesla, the EV market leader, has long touted plans for an affordable model.

Selling at a loss

For now though, most manufacturers are selling EVs at a loss, and deeper discounts are leading to more red ink.

In the first half of the year, the amount of money buyers paid for Ford’s already-unprofitable EVs declined, finance chief John Lawler said at an investor conference in June. The carmaker is cutting costs to offset the price pressure, which is expected to continue in the second half of 2024, he said.

Ford’s EV division lost about $1.3 billion in the quarter ended in March, excluding taxes and interest expenses.

EV prices are falling even more sharply on the used lot. As recently as mid-2022, preowned electric cars were going for a roughly 80 percent premium relative to gas equivalents, according to Cox Automotive. Recently, used EVs were only 9 percent higher.

CarGurus data shows nine out of the 10 used cars with the biggest declines in list price in the first half of the year were electric, including the Tesla Model 3 and Subaru Solterra. Used-car buyers can also claim a tax credit of up to $4,000 for their purchase under recently updated rules.

Used-car shoppers considering an electric must gauge what will happen with EV valuations in coming years, CarGurus analyst Kevin Roberts said. That math can be difficult given potentially rapid changes in battery technology in newer EVs, which could hurt used values.

“We’re in unknown territory at this point,” he said.