In the electric-vehicle race, it’s increasingly clear that not every competitor will make it to the finish line.

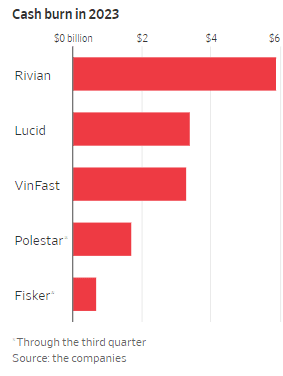

Companies like Rivian Automotive, Lucid Group and Fisker are burning through their cash reservers as they spend heavily on expanding factory production and sales – all while losing money on every vehicle they sell.

For consumers, the increased competition translates into steep discounts on some of the flashiest electric-powered vehicles. But for EV automakers, a slowdown in demand starts the clock that might determine how long they can keep the lights on.

Many of these companies first unveiled a lineup of innovative battery-powered cars and SUVs in 2018 and 2019, following Tesla’s pioneering success in the new market. It seemed like an army of upstarts was poised to supplant stodgy giants such as Ford Motor and Toyota as the next household name in the industry.

Electric cars were just starting to break into the mainstream, and sales of Tesla’s popular Model 3 sedan were taking off.

These young companies went public at stratospheric valuations, even though many had no revenue and little experience building a car. Investors, analysts and ordinary shoppers believed EV makers could emulate Tesla’s success in disrupting the traditional car market. Rivian’s market value briefly surged higher than that of Ford or General Motors.

Now, these companies are fighting to stay afloat amid stiff competition. Sales of battery-powered cars and trucks have been weaker than expected in the U.S., leading companies from Ford to Tesla to slash prices in an attempt to jump-start demand. Too few buyers have been willing to make the switch to fully electric vehicles, worried about the relatively high sticker prices, still-nascent charging infrastructure and the long-term reliability of EVs. Money-losing startups are pulling back on spending and delaying investments as they seek to conserve their remaining cash.

Some, like electric-pickup maker Lordstown Motors and battery-powered van company Arrival, have already filed for bankruptcy, and others are producing only a trickle of vehicles.

These carmakers that went public in an era of low interest rates and rising buzz around electric vehicles now have to prove they can withstand tougher conditions. They say they are focused on stabilizing their cash-bleeding operations, but not all of them may be able to weather the storm.

Here’s our guide on who could survive the battle of the fittest, using battery icons* to signify financial health.

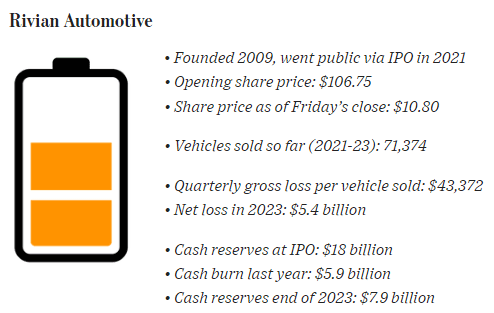

Vehicle Lineup: Rivian currently sells the R1T pickup and R1S SUV, which start at $69,900 and $74,900, respectively. The company also builds an electric commercial van for Amazon.com

Sales Pitch: Often compared to the clothing brand Patagonia, Rivian targets affluent, climate-conscious adventure seekers. Company founder RJ Scaringe has said he wanted to build an electric pickup because it is the most popular type of vehicle sold in the U.S.

How It Got Started: Scaringe, an avid outdoors lover, started the company in 2009, mortgaging his home for startup funds. Rivian raised billions privately from investors such as Amazon and Ford before going public in one of the most lucrative IPOs of the past decade. The company purchased a former Mitsubishi Motors factory in Normal, Ill., in 2017 to build its first vehicles.

Quirks of the Vehicles: Rivian’s vehicles have features meant to be useful off the beaten track, such as “camp mode” that levels the vehicle on an incline for comfortable in-car camping and a portable speaker stowed under the center console.

What Happened: Supply-chain logjams and problems getting parts to the assembly line meant that Rivian struggled to operate its factory at maximum capacity. The manufacturing challenges contributed to the company burning around $1.5 billion a quarter. The company also had to redesign key parts of its vehicles in an attempt to bring production costs down. While Rivian was able to overcome many of the logistics snarls holding up its factory output, the company is now warning of weaker demand for its models.

Where Are They Now? Rivian is still losing money each quarter and faces immediate challenges in meeting its goal of generating gross profit by the end of the year. The carmaker loses tens of thousands on every vehicle it sells, but executives say those losses are expected to decline this year. Rivian said it plans to build roughly the same number of vehicles this year as last.

Ultimately, Rivian aims to become one of the world’s largest carmakers. The first step in that plan is a new, $45,000 SUV called the R2, which it unveiled this month and is to go on sale in 2026. The company says this model is key to transforming into a profitable EV maker.

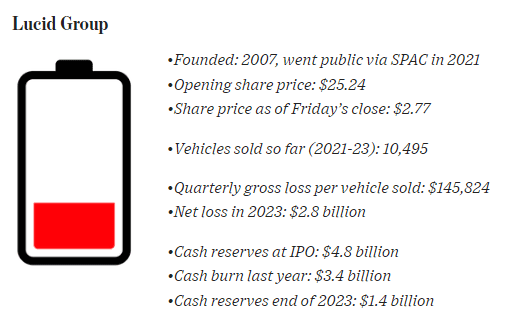

Vehicle Lineup: Lucid currently sells one model, the Air sedan, which ranges in price from the $69,900 Air Pure to the $249,000 Air Sapphire. An SUV, called the Gravity, is due to go on sale later this year.

Sales Pitch: Lucid sold investors on a plan to build high-end battery-powered vehicles, fueled by what it calls “the best electric-vehicle technology.” The company’s battery and electric-motor technology allow it to squeeze out more mileage than its competitors. Even the cheapest version of Lucid’s Air sedan can travel 410 miles on a single charge, around 100 miles farther than most electric vehicles available in the U.S.

How It Got Started: Lucid started life at a battery venture called Atieva. That company’s founders in 2013 hired Peter Rawlinson, a former Tesla executive, who was brought in to help Atieva pivot to car manufacturing. In 2016, Atieva changed its name and Lucid was born. When the company started to run out of cash in 2018, a $1 billion investment from the Saudi Arabia Public Investment Fund saved it. Rawlinson became chief executive in 2019.

What Happened: At first, Lucid appeared to have a deep well of demand, reporting more than 25,000 reservations for the Air in early 2022. With a factory in Casa Grande, Ariz., Lucid seemed both well-funded and well-prepared. Instead, sales have been relatively flat since the second half of 2022. Lucid began flagging slower demand for the Air last February—sooner than other startups on this list. In response, the company has been spending more on marketing and cutting prices to help boost demand.

Where Are They Now? Lucid’s newest factory in Saudi Arabia is currently assembling vehicles as part of a deal to sell at least 50,000 to that country’s government. The company is also slated to start production of the Gravity this year. Company executives say the vehicle will appeal to a wider audience, because SUVs outsell sedans three-to-one in the U.S. Lucid also says it is preparing to broaden its lineup further in 2026, when it plans to launch a new, more affordable midsize vehicle.

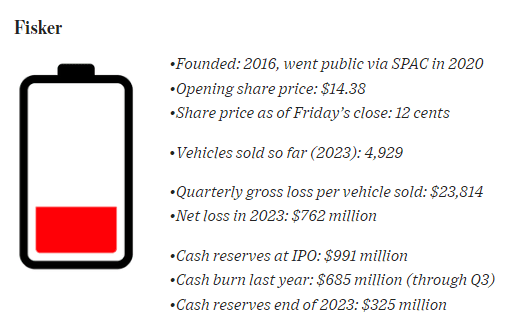

Vehicle Lineup: Fisker currently sells the Ocean SUV, which costs between $38,999 and $61,499.

Fisker’s Sales Pitch: Fisker has taken a different approach than other startups, employing what it calls an asset-light business model. Rather than building the cars itself, it contracts that work out to an outside company. That way it doesn’t have to own a factory itself or employ a manufacturing workforce.

How It Got Started: This is the second electric-car startup started by former BMW and Aston Martin car designer Henrik Fisker, who is also CEO. His first company, Fisker Automotive, sold a $100,000 plug-in hybrid called the Fisker Karma, but it went bankrupt in 2013 after 300 vehicles were destroyed in a hurricane and its battery supplier went out of business.

Four Unique Features: “Each Fisker has to have at least four unique features that have to be either best-in-class or something nobody else has,” says the Fisker CEO. The features include the Fisker Ocean’s “California mode,” which opens every glass panel, except the windshield, and a small foldout shelf dubbed the taco tray. The company’s forthcoming Alaska pickup truck has a “cowboy hat holder” and “the world’s largest cup holder.”

What Happened: Fisker only started delivering vehicles to customers halfway through 2023 after missing self-imposed deadlines. The company says it ran into delays securing parts and regulatory approval. As a result, it slashed its production outlook twice last year, but ultimately fell short of even its reduced goals.

Where Are They Now? Fisker warned at the end of February that it risked running out of cash this year. As of mid-March, the company had nearly 5,000 unsold vehicles and its cash reserves had dwindled to $89 million. Fisker says it is raising $150 million in fresh funds from an investor and is negotiating with a large carmaker for another investment. Fisker has hired restructuring advisers to help prepare for a potential bankruptcy filing, according to people familiar with the matter.

Note: Gross profit per vehicle, net loss and cash burn are as of end of September, 2023, because the company has yet to release full-year results.

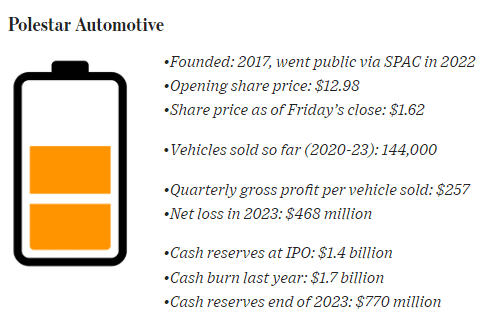

Vehicle Lineup: The carmaker sells three models: the $49,200 Polestar 2 sedan, $73,400 Polestar 3 SUV and approximately $60,000 Polestar 4 SUV.

Sales Pitch: Like Fisker, Polestar doesn’t own manufacturing facilities, and instead contracts to have its vehicles built at other companies’ factories in China, South Korea and the U.S. Unlike most electric-car makers, Polestar says it doesn’t want to make a mass-market EV. Instead, the company pitches itself as a sportier alternative to Volvo.

How It Got Started: Volvo Car and its Chinese parent, Geely, created Polestar as an EV-only brand in 2017. The company started by selling a hybrid, the Polestar 1, before launching the fully electric Polestar 2 in 2020.

Quirk: Polestar vehicles bear more than a passing resemblance to electric vehicles made by Volvo. That may not be surprising given that the CEO, finance chief, operations head and lead designer are all former Volvo executives.

What happened: Polestar appeared to have the smoothest launch of any of the current crop of EV startups. It has built over 100,000 vehicles since starting production and has even turned a profit in some quarters. But Polestar has faced slowing demand for its Polestar 2 sedan and the launch of its Polestar 3 SUV was delayed after Volvo ran into software development issues. The company has slashed its production outlook and Volvo said last month that it will sell the majority of its 48% stake in Polestar.

Where Are They Now? Polestar’s finances are now stable after raising nearly $1 billion in debt last month. Production of the Polestar 3 has started in China, and a U.S. plant is due to start producing the vehicle later this year. Polestar’s chief financial officer says the company is targeting a double-digit gross margin by the end of 2024. The company says the U.S. launch of the Polestar 3 SUV this year will help boost sales.

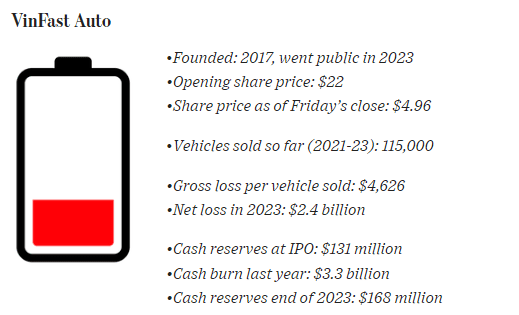

Vehicle Lineup: In the U.S., VinFast currently sells the $46,000 VF8 SUV. A larger SUV called VF9 is expected to go on sale this year, starting at $79,800. VinFast also sells battery-powered scooters in Vietnam.

How It Got Started: VinFast was created in 2017 by Pham Nhat Vuong, the billionaire owner of Vietnamese conglomerate Vingroup, which operates a diverse array of businesses from hospitals to theme parks. VinFast built a massive $1.5 billion factory east of Hanoi, which the company has said will be capable of producing nearly a million vehicles a year by 2026.

VinFast’s Sales Pitch: VinFast aims to compete with Chinese EV startups like BYD and NIO, and says that building cars in Vietnam means its labor costs are even lower than those of Chinese competitors. The company is expanding across Southeast Asia and in India, while also aiming to increase its sales in the U.S.

Quirk: Early buyers in the U.S. were offered free stays in one of Vingroup’s resorts in Vietnam. People who buy a home in Vietnam from the company’s property arm may also get a free car as part of the deal.

What Happened? VinFast tried an innovative pricing strategy in which it sold cars to customers but rented the lithium-ion batteries that power the vehicles separately. The company said the plan allowed customers to pay less upfront for VinFast vehicles, but ended up ditching the plan in the U.S. for now, because customers found it confusing. Ultimately, VinFast only delivered a little over 3,000 vehicles to U.S. customers last year, according to Motor Intelligence.

The company also had a rocky debut on Wall Street. Initially, its share price skyrocketed, briefly making VinFast more valuable than Ford or GM, in part because only a small percentage of the company’s shares were available for trade, boosting demand for them. Since then, the stock price has tanked as the company faced challenges getting its first batch of cars to U.S. consumers. Reviewers panned the VF8 for quality issues.

Where Are They Now? VinFast is building a $2 billion factory in North Carolina, which will allow its vehicles to potentially qualify for a federal tax credit. Over 70% of VinFast’s passenger vehicles and nearly half of its scooter sales last year were to a taxi company owned by Vuong, the head of Vingroup. VinFast has said it plans to deliver 100,000 electric cars and SUVs this year, but hasn’t said how many will be to customers outside of the Vingroup network.

* NOTE: A fully charged battery would signify a profitable, cash-generating business. Two bars of charge denotes a company draining its cash reserves but has more cash on hand than it spent last year. A company whose cash burn last year was greater than the sum of its current cash and cash equivalents is assigned one bar of charge.