EAST LANSING, Mich. – Oct. 16, 2023 – Michigan economic consultancy Anderson Economic Group, LLC reports that total economic losses from the UAW’s strike against the Detroit 3 OEMs have now reached $7.7 billion. Losses are calculated through the fourth full week, which ended at midnight on October 12.

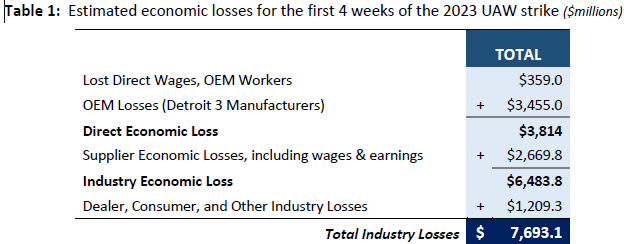

AEG estimates the following cumulative losses through week four:

- Wages of OEM Workers: $359 million

- OEM Losses: $345 billion

- Supplier Wages and Earnings: $2.67 billion

- Dealers, Customers, Other Industry Losses: $1.21 billion

These figures do not include plant closures, additional strike targets, or layoffs that took effect

on or after Friday, October 12. These will be included in our loss calculations in the fifth and any

successive weeks.

Week Five is Danger Zone

“We’ve entered the danger zone for many suppliers, and more than one production line.

Without a settlement soon, a plausible restart with higher costs will likely lead to some

permanent losses of production, and suppliers that will need financial assistance to return to

operation. “

Anderson noted that the magnitude of losses the firm previously estimated were now being

corroborated from other sources. “We’re already seeing retail sales, airline travel, and income

tax collections dropping in the State of Michigan. There are also increasing layoffs among

vulnerable suppliers.”

“Most of these costs” he added, “are being borne by workers and by small- and medium-sized

businesses, not by the Detroit 3.”

Estimating Economic Losses

To determine the ongoing economic impact of the UAW “stand-up” strikes, AEG estimates aggregate

losses that include:

- Lost wages to workers, including striking workers and others temporarily laid off or forced to

decrease work hours. AEG estimates cover both UAW and non-union auto workers, along with

workers employed by impacted suppliers. Estimates were made based on the number of UAW

workers in the U.S, average daily wages, and lost health care benefits. - Lost earnings for the Big Three auto manufacturers. AEG estimates company losses, noting

wages that would not be paid to striking workers. - Supplier losses. Because a strike reduces demand for automotive parts and components, AEG

estimates lost supplier wages and earnings. - Dealer, customer, and other auto industry losses. Automotive dealers and custmers needing repairs both experience strike-related losses.

Loss estimates do not include unemployment benefits or unemployment taxes; income taxes on

wages; any settlement bonuses (which are transfers from shareholders to workers and do not

represent U.S. income lost); or any reputational damage to the union or the employer(s). We count

strike pay as a loss to the union and a gain to striking employees.

Source: Anderson Economic Group, LLC.

Notes: Week 4 revisions include refining the direct wage loss category to include only OEM workers, with other wage

losses in the supplier category; adjusting for GM covering some health care costs for striking workers; downward

revisions in prior week losses for dealers, given current inventory levels; and upward revisions in supplier losses given

additional layoffs. Results by category are not precisely comparable with earlier releases.

Strike-caused economic losses include only direct losses to affected workers, businesses, and customers.

Estimated losses do not include settlement bonuses, transfer payments, strike pay, unemployment insurance taxes or

benefits, or income tax changes. OEM stands for Original Equipment Manufacturer.

Columns may not total precisely due to rounding. Presumes no permanent change in production or employment

caused by strike. Company losses are direct economic losses and will differ from accounting charges. They include

both facility losses and production losses spread across multiple facilities.

“Week 1” is defined as Friday, September 15 – Thursday, September 22, 2023. “Week 2” is defined as Friday,

September 23 – Thursday, September 28. “Week 3” is defined as Friday, September 29 – Thursday, October 5. “Week

4” is defined as Friday, October 6 – Thursday, October 12. Estimates for time periods during a strike are necessarily

imprecise, reflecting apportionment and estimates of costs incurred under fixed contracts over longer periods of time.

2023 Research Methodology

The firm’s consultants followed the same proven methodology used to estimate impacts from

the 2019 UAW strike, the threatened 2022 rail union strike, the threatened 2023 Teamsters

strike against UPS, two West Coast port shutdowns, the 2003 East Coast electrical blackout, the

2022 Türkiye-Syria Earthquake, and other significant events in the firm’s 27-year history. Inputs

to the estimates included production and sales figures for the industry and specific automakers,

financial disclosures including form 10Ks, contract documents, public statements by the union

and the companies involved, and other industry and economic sources. AEG has calibrated

estimates by comparing recorded losses in GDP and earnings in affected states after prior

events. The firm further compared its estimated cost of the 2019 UAW strike against General

Motors with later reported GDP in Michigan, Ohio, and the U.S., and with accounting losses

reported by General Motors in early 2020.

Follow AEG’s ongoing strike analysis at www.andersoneconomicgroup.com/news/uaw-strike-analysis-2023/ , along with key economic indicators for the auto industry on our Automotive

Dashboard.

About Anderson Economic Group, LLC

Clients of AEG have included original equipment manufacturers, tier I and tier II suppliers,

automotive, business and manufacturing trade groups, auto dealers, labor unions, state

governments, and colleges and universities. No party to the current labor dispute

commissioned our analysis.

Anderson Economic Group routinely produces meticulous studies that illuminate economic

trends in Michigan and across the U.S. AEG’s practice areas include public policy and economic

analysis, market and industry analysis, and strategy and business valuation. For more

information about the East Lansing and Chicago-based company, now in its 27th year, see

AndersonEconomicGroup.com.