Success of Li Auto underlines risks of an all-or-nothing approach to the shift to electric vehicles

Don’t write off hybrid electric vehicles.

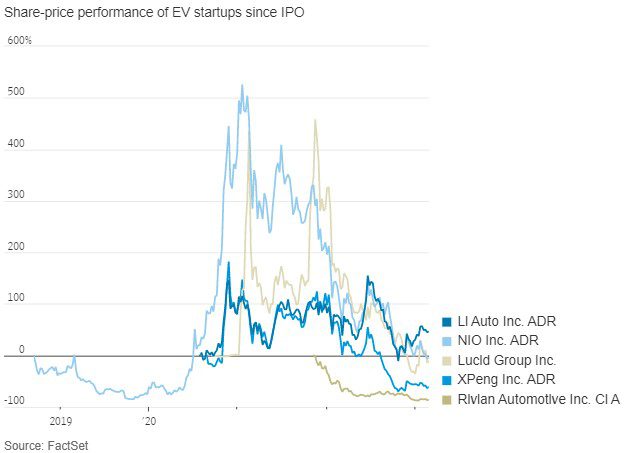

After Tesla, the most highly valued U.S.-listed EV company isn’t homegrown Rivian RIVN 4.53%increase; green up pointing triangle or Lucid LCID 4.39%increase; green up pointing trianglebut Li Auto, a Chinese manufacturer that went public in 2020 by listing American depositary receipts. It has a market value of roughly $26 billion, compared with $20 billion for NIO, which took the Chinese ADR route earlier, $17 billion for Rivian and $15 billion for Lucid.

It is no surprise that Chinese EV startups are worth more than American ones. China is a more mature EV market, and Li and NIO—both premium brands—are further along their manufacturing ramps than Rivian and Lucid. Li delivered 46,319 vehicles in the fourth quarter and NIO 40,052; Rivian and Lucid reached just 8,054 and 1,932, respectively.

Li said alongside its results Monday that it expects to ship 52,000 to 55,000 vehicles this quarter. Compared with their U.S. peers, the Chinese ADRs are cheap relative to the number of vehicles they make.

What is surprising is that Li has overtaken NIO to lead the new generation of Chinese startups. Li doesn’t make the purely electric vehicles that were popularized by Tesla and that have become the technological focus of other startups and most old-school car manufacturers. Instead, it specializes in extended-range EVs, which use a generator to power up the battery with gasoline if it runs out of juice.

Li launched two sport-utility vehicles with this technology last year, the L9 and L8. The smaller L7, deliveries of which start this week, is expected to run for about 130 miles without using the generator. For longer trips, filling up the tank extends the range to almost 700 miles.

The popularity of what is essentially a plug-in hybrid, albeit a cutting-edge one, is notable in the Chinese market, which has in many ways led the transition to EVs. After years of government promotion, pure EVs accounted for about 21% of all vehicles sold in the country last year, according to data provider EV-Volumes—much higher than in Europe (13%) or the U.S. (5.5%). But Chinese charging infrastructure is patchy, leading to range anxiety. Brokerage Bernstein expects 65% growth in plug-in hybrid sales in China this year, versus 25 percent growth for pure EVs.

In Europe, plug-in hybrids had a difficult 2022, with sales down 3%. They are often dismissed as a transition technology that will do no more than bridge the gap between conventional cars and pure EVs. GM, Ford, Volkswagen and others have tried to jump ahead in EVs by sidelining hybrid technology.

Li’s success in China underlines the risk that this all-or-nothing approach turns out to be shortsighted. Each market will follow its own path, but it is plausible that the Chinese pattern could be repeated in the West: The first rush of EV sales could lead to a second wave for hybrid adoption as regions less well served by charging infrastructure, or buyers who drive longer distances, join the transition on terms that work for them.

It isn’t a reason to shirk EV investments, but car makers with a more nuanced approach to the industry transition, such as Toyota, could end up looking smarter than they do now.