By Jeanne Whalen

Uncertainty over how the credits work could leave buyers and dealers frustrated until automakers sort through new Treasury Department rules expected in March

“Obviously, lowering the perceived price by $7,500 is critical,” said Brett Smith, an analyst at the Center for Automotive Research in Ann Arbor, Mich. “But consumers don’t have certainty, and neither do dealers. … In the meantime, it may confuse and frustrate them, and they go off and buy a hybrid instead.”

The consumer tax credits, passed in the Inflation Reduction Act, are a centerpiece of the Biden administration’s green-energy push, which aims to boost high-tech employment, lower carbon emissions and reduce U.S. reliance on Chinese-made goods. Industry observers see them as an important part of making electric vehicles more affordable.

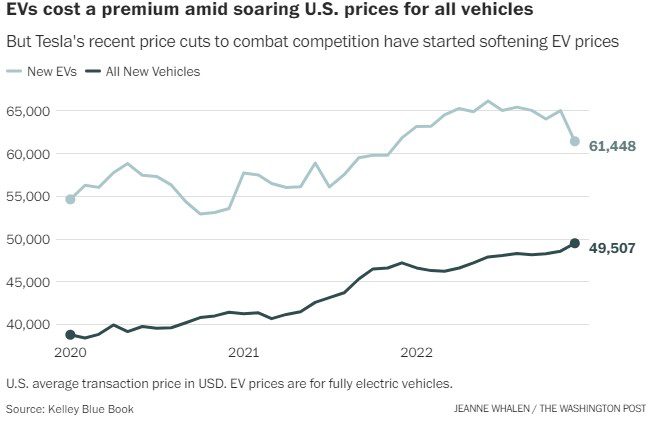

Many people at the recent Washington Auto Show expressed interest in EVs but hesitated over the prices that are still, on average, higher than for other cars.

Perusing some fully electric Hyundai models at the show, Ally Burleson-Gibson said she was leaning toward a hybrid. “Obviously, you’re putting out quite a bit more for some of the higher-end EVs … the lower price point for some of the hybrids is a little more attractive at this point,” she said.

The government has published a list of about three dozen electric vehicles that currently qualify for the tax credit, but the list is expected to change — and possibly grow shorter — after the Treasury Department releases new rules on battery content by the end of March, industry executives say. Automakers expect they will need time to determine which batteries and vehicles meet those rules.

Buyer uncertainty may continue even after the rules are published.

A Treasury document released in December attempted to help automakers prepare by “detailing the anticipated direction” of the new rules, agency spokeswoman Ashley Schapitl said.

For now, electric vehicles assembled in North America and priced under certain levels qualify for the full tax credit, if the buyer’s adjusted gross income does not exceed the thresholds established in the Inflation Reduction Act —$150,000 for single taxpayers and $300,000 for married couples filing jointly.

But once the new rules are published next month, to qualify for the full credit, automakers must also show that 40 percent of the value of the “critical minerals” in the vehicle’s battery come from the United States or a country with which the U.S. has a free-trade agreement, and that 50 percent of the value of the battery’s components are made in North America. Treasury is still working out how to calculate those values, among other details.

“After the guidance comes out, fewer vehicles are likely to qualify for the full credit,” said John Bozzella, chief executive of the Alliance for Automotive Innovation, an industry group. “There’s going to be confusion in the marketplace because if I’m a customer … it’s just not intuitive to me what vehicles qualify.”

In an emailed statement, General Motors said that Treasury “has an important opportunity to provide the needed clarity to advance the policy aims of the Inflation Reduction Act.” It added that it believes GM is “well-positioned” to continue qualifying for credits because it has been working to bring as much of its supply chain to the United States as possible.

The battery uncertainties come on top of other aspects of the credit that have confused EV shoppers, said Mike Stanton, chief executive of the National Automobile Dealers Association.

The federal government’s online guidance about how the credit works is dense and complicated, Stanton said, holding up a printout of a multi-page IRS fact sheet. Also, buyers need to figure out on their own whether they meet the adjusted gross income requirements — dealers can’t do that for them because they aren’t qualified to give tax advice, Stanton said.

That’s “going to be a challenge because a lot of consumers won’t understand that; they’re going to go in, they’re going to ask the dealer,” he said.

Ambrose Conroy, an automotive expert and founder of a consulting firm, Seraph, that provides advice to automakers, said even he has been perplexed by the rules as he tries to buy two electric vehicles.

“I’m totally confused by it,” he said. “My accountant is totally confused and my tax lawyers are totally confused. Do you get the tax credit if you lease it, but not buy it? There are a lot of questions, and there’s not a lot of clarity.”