Behind a rising number of outages are new stresses on the system caused by aging power lines, a changing climate and a power-plant fleet rapidly going green

By Katherine Blunt

The U.S. electrical system is becoming less dependable. The problem is likely to get worse before it gets better.

Large, sustained outages have occurred with increasing frequency in the U.S. over the past two decades, according to a Wall Street Journal review of federal data. In 2000, there were fewer than two dozen major disruptions, the data shows. In 2020, the number surpassed 180.

Utility customers on average experienced just over eight hours of power interruptions in 2020, more than double the amount in 2013, when the government began tracking outage lengths. The data doesn’t include 2021, but those numbers are certain to follow the trend after a freak freeze in Texas, a major hurricane in New Orleans, wildfires in California and a heat wave in the Pacific Northwest left millions in the dark for days.

The U.S. power system is faltering just as millions of Americans are becoming more dependent on it—not just to light their homes, but increasingly to work remotely, charge their phones and cars, and cook their food—as more modern conveniences become electrified.

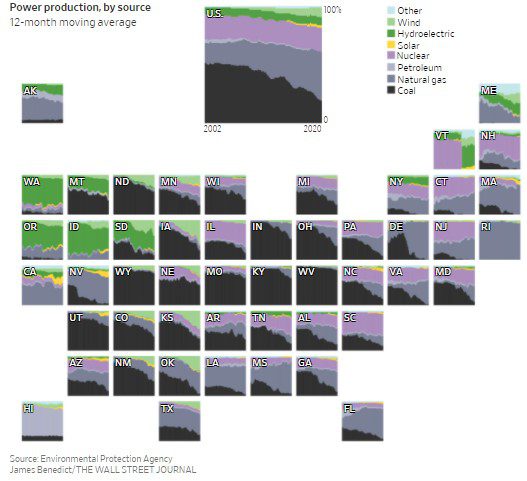

At the same time, the grid is undergoing the largest transformation in its history. In many parts of the U.S., utilities are no longer the dominant producers of electricity following the creation of a patchwork of regional wholesale markets in which suppliers compete to build power plants and sell their output at the lowest price. Within the past decade, natural gas-fired plants began displacing pricier coal-fired and nuclear generators as fracking unlocked cheap gas supplies. Since then, wind and solar technologies have become increasingly cost-competitive and now rival coal, nuclear and, in some places, gas-fired plants.

Regulators in many parts of the country are attempting to further speed the build-out of renewable energy in response to concerns about climate change. A number of states have enacted mandates to eliminate carbon emissions from the grid in the coming decades, and the Biden administration has set a goal to do so by 2035.

The pace of change, hastened by market forces and long-term efforts to reduce carbon emissions, has raised concerns that power plants will retire more quickly than they can be replaced, creating new strain on the grid at a time when other factors are converging to weaken it.

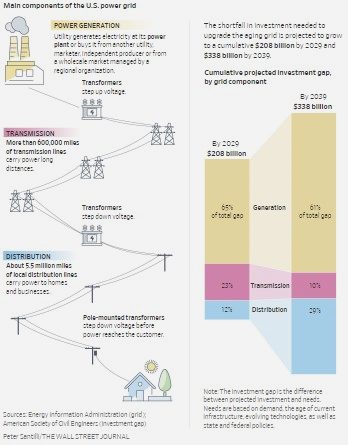

One big factor is age. Much of the transmission system, which carries high-voltage electricity over long distances, was constructed just after World War II, with some lines built well before that. The distribution system, the network of smaller wires that takes electricity to homes and businesses, is also decades old, and accounts for the majority of outages.

A report last year by the American Society of Civil Engineers found that 70 percent of transmission and distribution lines are well into the second half of their expected 50-year lifespans. Utilities across the country are ramping up spending on line maintenance and upgrades. Still, the ASCE report anticipates that by 2029, the U.S. will face a gap of about $200 billion in funding to strengthen the grid and meet renewable energy goals.

Another factor is the changing climate. Historically unusual weather patterns are placing great stress on the electric system in many parts of the U.S., leading to outages.

Weather-related problems have driven much of the increase in large outages shown in federal data, topping 100 in 2020 for the first time since 2011. Scientists have tied some of the weather patterns, such as California’s prolonged drought and wildfires and the severity of floods and storms throughout the country, to climate change. They project that such events will likely increase in years to come. Unlike electric systems in Europe, distribution and transmission lines in the U.S. were typically built overhead instead of buried underground, which makes them more vulnerable to high winds and other weather.

Those weather extremes are raising the costs of power network upgrades for utilities all over the country. That in turn is set to raise power bills for homeowners and businesses.

Public Service Enterprise Group Inc., which serves 2.3 million electric customers in New Jersey, plans to invest as much as $16 billion in transmission and distribution improvements over the next five years to replace aging equipment and make the grid more resilient to extreme weather events, such as a highly unusual spate of tornadoes that swept the state last year.

Ralph Izzo, PSEG’s chief executive, said the plan is critical to ensuring reliability, especially as customers become more dependent on the grid to charge electric vehicles and replace traditional furnaces and gas appliances with electric alternatives. The movement toward electrification is in part driven by consumers, amid mounting concerns about climate change, as well as initiatives among cities and towns to enact mandates aimed at phasing out natural gas for cooking and heating.

“That resiliency needs to be further enhanced, because the solutions to climate change are going to put more challenges on the grid,” Mr. Izzo said. “Those are the kinds of things that really keep you awake at night.”

The historic shift to new sources of energy has created another challenge. A decade ago, coal, nuclear and gas-fired power plants—which can produce power around the clock or fire up when needed—supplied the bulk of the nation’s electricity. Since then, wind and solar farms, whose output depends on weather and time of day, have become some of the most substantial sources of power in the U.S., second only to natural gas.

Grid operators around the country have recently raised concerns that the intermittence of some electricity sources is making it harder for them to balance supply and demand, and could result in more shortages. When demand threatens to exceed supply, as it has during severe hot and cold spells in Texas and California in recent years, grid operators may call on utilities to initiate rolling blackouts, or brief intentional outages over a region to spread the pain among everyone and prevent the wider grid from a total failure.

Companies around the country are rapidly adding large-scale batteries to store more intermittent power so it can be discharged during peak periods after the sun falls and wind dies. But because such storage technology is somewhat new, and was, until recently, relatively expensive, it remains a small fraction of the electricity market, and grid operators agree much more will be needed to keep the system stable as more conventional power plants retire.

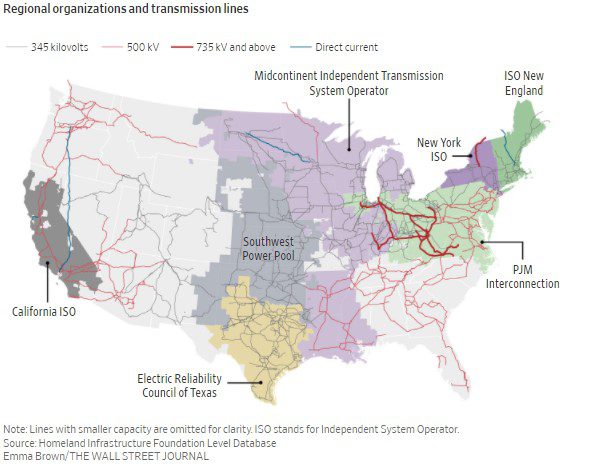

The problem could soon threaten New York City. The New York Independent System Operator, or NYISO, which oversees the state’s power grid, last month warned of possible supply shortages in the coming years as several gas-fired power plants close or operate less frequently in light of stricter state air quality rules. New York, which has set a goal to eliminate emissions from its electricity supplies by 2040 and no longer has any coal-fired power plants, also recently shut down a nuclear plant some 30 miles north of Manhattan after critics for years called it a safety hazard.

NYISO said its reserve margins—how much electricity it has available beyond expected demand—are shrinking, increasing the risk of outages. A 98-degree, sustained heat wave could result in shortfalls within New York City as soon as next year, a circumstance that would likely force NYISO to call for rolling blackouts for the first time ever.

“We already foresee razor-thin margins,” said Zach Smith, NYISO’s vice president of system and resource planning. “The risk is compounded when we take into consideration unforeseen events.”

New York is adding substantial amounts of new wind and solar generation, as well as battery storage, and NYISO has said that it is critical that the projects remain on track to improve the stability of the system in the coming years. Already, wind and solar developers across the country are facing headwinds related to supply-chain issues, inflation and the amount of time it often takes to get approval to connect to the grid.

The North American Electric Reliability Corp., a nonprofit overseen by the Federal Energy Regulatory Commission that develops standards for utilities and power producers, warned in a report last month that the Midwest and West also face risks of supply shortages in the coming years as more conventional power plants retire.

Within the footprint of the Midcontinent Independent System Operator, or MISO, which oversees a large regional grid spanning from Louisiana to Manitoba, Canada, coal- and gas-fired power plants supplying more than 13 gigawatts of power are expected to close by 2024 as a result of economic pressures, as well as efforts by some utilities to shift more quickly to renewables to address climate change. Meanwhile, only 8 gigawatts of replacement supplies are under development in the area. Unless more is done to close the gap, MISO could see a capacity shortfall, NERC said. MISO said it is aware of this potential discrepancy but declined to comment on the reasons for it.

Curt Morgan, CEO of Vistra Corp. , which operates the nation’s largest fleet of competitive power plants selling wholesale electricity, said he is worried about reliability risks in New York, New England and other markets as state and federal policy makers pursue ambitious goals to quickly phase out fossil fuel-fired power plants. His concern is that the plants will retire before replacements such as wind, solar and battery storage come online, he said, given the cost and challenge of quickly building enough batteries to have meaningful supply reserves.

“Everything is tied to having electricity, and yet we’re not focusing on the reliability of the grid. That’s absurd, and that’s frightening,” he said. “There’s such an emotional drive to get where we want to get on climate change, which I understand, but we can’t throw out the idea of having a reliable grid.”

Serious electricity supply constraints have historically been rare. Most recently, the Texas grid operator called for sweeping outages during an unusually strong winter storm last February that caused power plants and natural gas facilities of all kinds to fail in subfreezing temperatures. Millions of people were in the dark for days, and more than 200 died.

California, which experienced outages during a West-wide heat wave in the summer of 2020, also called on residents to conserve power several times last summer amid a historic drought that constrained hydroelectric power generation across the region. The state is now racing to secure large amounts of renewable energy and batteries in the coming years to account for the closure of several conventional power plants, as well as potential constraints on power imported from other states when temperatures rise.

California state Sen. Bill Dodd, Democrat from Napa, recently introduced legislation that would require the state’s electricity providers to offer programs that compensate large industrial power users for quickly reducing electricity use when supplies are tight, helping to ease strain on the grid.

“We just can’t go down the road of having rolling blackouts again,” Mr. Dodd said. “People expect their government to keep the lights on, and our reliability situation in California still isn’t where it needs to be.”

Similar challenges have emerged elsewhere in the West. PNM Resources Inc., a utility that provides electricity for more than 525,000 customers in New Mexico, has warned that it would likely have to resort to rolling blackouts this coming summer, following the June retirement of a large coal-fired power plant. It has recently proposed keeping one of the generating units online for an extra three months to help meet demand during the hottest months of the year.

Tom Fallgren, PNM’s vice president of generation, said the company faced significant delays in getting regulatory approval for several solar projects to replace the coal plant’s output, as well as construction delays tied to supply-chain issues. A spokeswoman for the New Mexico Public Regulation Commission said the agency does its best to address all utility proposals in a fair and timely manner.

Mr. Fallgren said he anticipates even steeper challenges in the coming years as the company works to replace output from a nuclear plant with a combination of renewable energy and battery storage.

“We used to do resource planning on a spreadsheet. It used to be very simple,” he said. “The math is just astronomically more complicated today.”

One of the biggest challenges facing grid operators and utility companies is the need for better technology that can store large amounts of electricity and discharge it over days, to account for longer weather events that affect wind and solar output. Most large-scale batteries currently use lithium-ion technology, and can discharge for about four hours at most.

Form Energy Inc., a company that is working to develop iron-air batteries as a multiday alternative to lithium-ion, recently announced plans to work with Georgia Power, a utility owned by Southern Co., to develop a battery capable of supplying as many as 15 megawatts of electricity for 100 hours. It would be a significant demonstration of the technology, which the company is aiming to broadly commercialize by 2025.

Form Energy CEO Mateo Jaramillo said the U.S. has ample capability to produce power, but increasingly finds itself short on electricity during periods of high demand and low production as the generation mix changes.

“That’s sort of a feature of this new grid that we find ourselves with today,” he said.

Other outage risks are mounting as extreme weather events test the strength of the grid itself. A spate of strong storms in Michigan last summer left hundreds of thousands of residents in the dark for days as utility companies rushed to make repairs. DTE Energy Co. , a utility with 2.2 million electricity customers in southeastern Michigan, had more than 100,000 customers lose power.

CEO Jerry Norcia called the storm barrage unprecedented, and said the company needed to invest more heavily in reliability. DTE now plans to spend an additional $90 million to keep trees away from power lines and is working to hire more people to help maintain its system. But it may take time for such utility improvements to fully materialize, and meanwhile, consumers may suffer further inconveniences.

Michael Fuhlhage, a professor at Wayne State University who lives just outside of Detroit, hadn’t thought much about the power grid until a few years ago, when he began noticing an uptick in the number of times severe weather caused his lights to go out. He has since started measuring outage length by the number of trash bags it takes to clean out his fridge.

In August, a storm caused a dayslong outage while he was visiting family, and he returned home to find a mess of spoiled food.

“That was probably a three-garbage bag storm,” he said. “We worry every time there’s some kind of weather coming in now, and that’s not an anxiety we had to deal with before.”